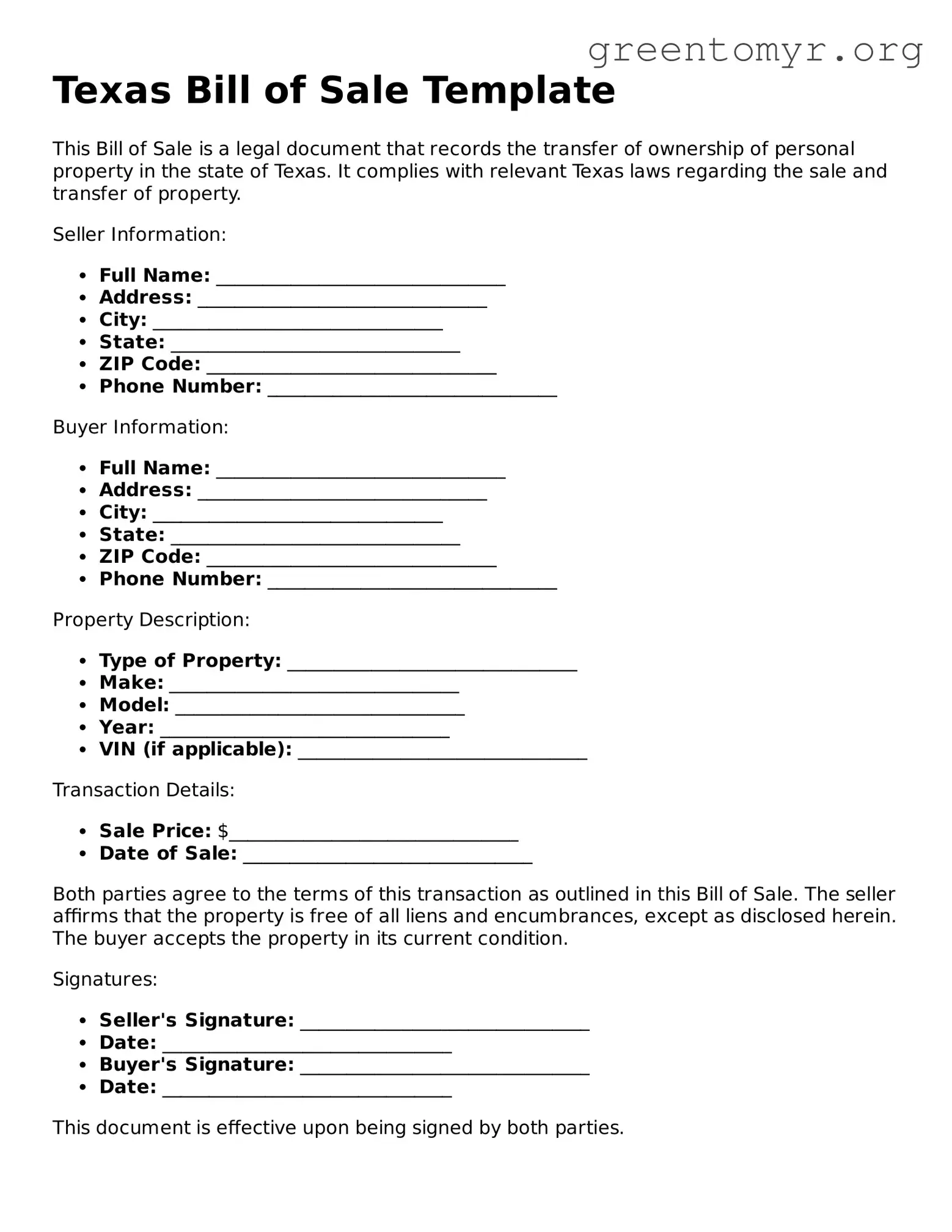

Filling out the Texas Bill of Sale form correctly is crucial for both buyers and sellers. However, several common mistakes can lead to complications down the road. One of these mistakes is failing to include accurate identification information. Each party involved in the transaction must provide their full names, addresses, and contact information. Omitting or incorrectly entering these details can create confusion and may hinder effective communication after the sale.

Another frequent error involves the misrepresentation of the item being sold. The Bill of Sale must detail the item, providing a complete description. This includes not only the make and model but also the Vehicle Identification Number (VIN) for vehicles. Buyers rely on this information to ensure they are receiving the item as expected. An incomplete description can lead to disputes or misunderstandings between the involved parties.

People often overlook the requirement of specifying the purchase price. It is essential to indicate the amount agreed upon in the transaction. Not stating a purchase price or leaving it blank can result in legal challenges later, especially if the transaction is called into question. Buyers and sellers must be clear and honest about the financial terms of the sale.

Additionally, individuals sometimes neglect to sign the document appropriately. Both the buyer and the seller's signatures are vital to validate the Bill of Sale. Without the proper signatures, the form may not hold up in legal contexts. Furthermore, some individuals fail to ensure that the signing occurs in the presence of a witness, which can add an additional layer of legitimacy to the document.

It is also common for parties to forget to date the Bill of Sale. The date serves as an important reference point, marking when the transaction occurred. This information is essential for record-keeping purposes, especially in the event of future disputes. A lack of a date can create ambiguity and complicate matters, particularly if legal action is initiated later.

Finally, another overlooked aspect is the absence of thorough record-keeping. After generating the Bill of Sale, individuals should keep a copy for their records. Failing to do so may pose challenges if questions arise later about the transaction. Proper documentation ensures that both parties can confirm the terms of their agreement, acting as a safeguard for their interests.