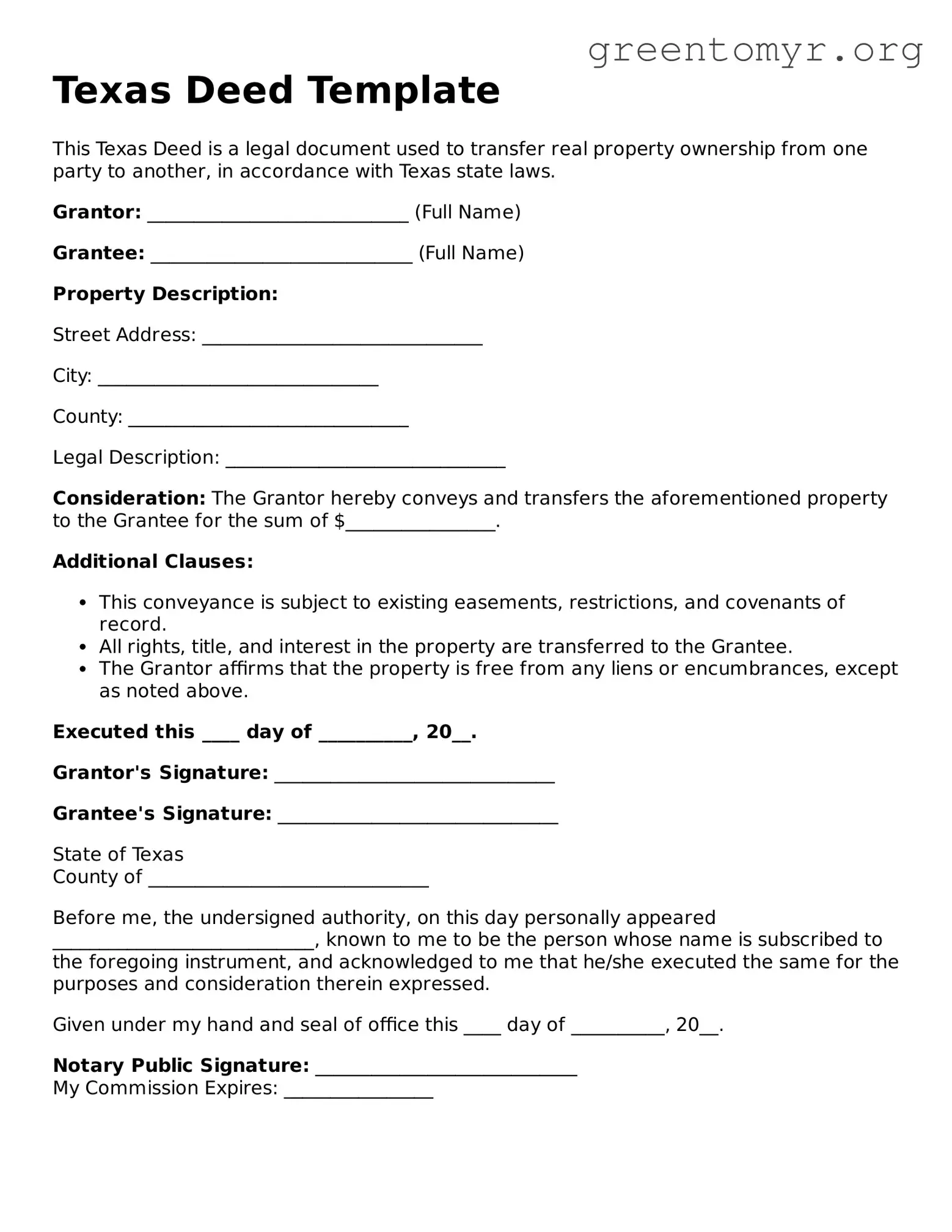

Texas Deed Template

This Texas Deed is a legal document used to transfer real property ownership from one party to another, in accordance with Texas state laws.

Grantor: ____________________________ (Full Name)

Grantee: ____________________________ (Full Name)

Property Description:

Street Address: ______________________________

City: ______________________________

County: ______________________________

Legal Description: ______________________________

Consideration: The Grantor hereby conveys and transfers the aforementioned property to the Grantee for the sum of $________________.

Additional Clauses:

- This conveyance is subject to existing easements, restrictions, and covenants of record.

- All rights, title, and interest in the property are transferred to the Grantee.

- The Grantor affirms that the property is free from any liens or encumbrances, except as noted above.

Executed this ____ day of __________, 20__.

Grantor's Signature: ______________________________

Grantee's Signature: ______________________________

State of Texas

County of ______________________________

Before me, the undersigned authority, on this day personally appeared ____________________________, known to me to be the person whose name is subscribed to the foregoing instrument, and acknowledged to me that he/she executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office this ____ day of __________, 20__.

Notary Public Signature: ____________________________

My Commission Expires: ________________