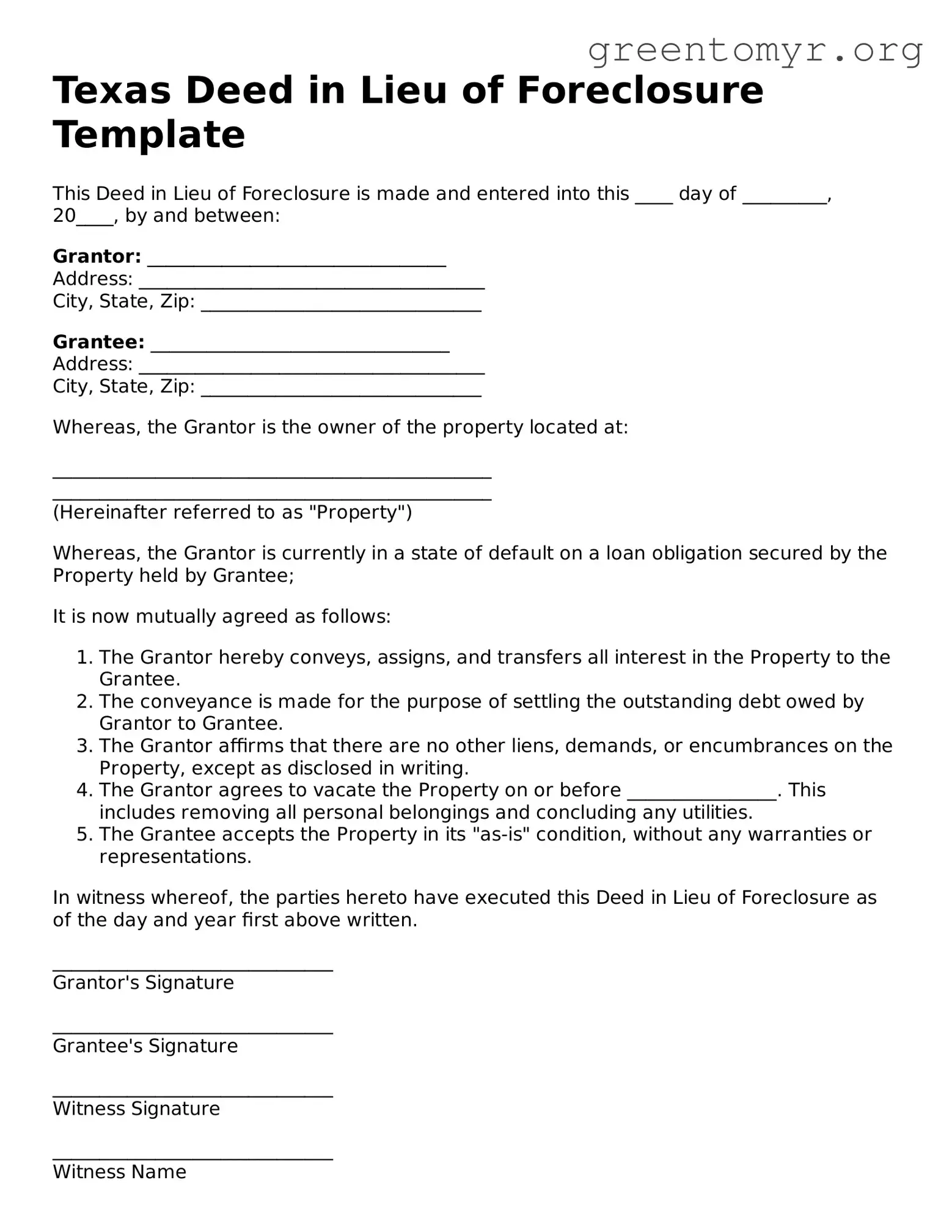

Texas Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made and entered into this ____ day of _________, 20____, by and between:

Grantor: ________________________________

Address: _____________________________________

City, State, Zip: ______________________________

Grantee: ________________________________

Address: _____________________________________

City, State, Zip: ______________________________

Whereas, the Grantor is the owner of the property located at:

_______________________________________________

_______________________________________________

(Hereinafter referred to as "Property")

Whereas, the Grantor is currently in a state of default on a loan obligation secured by the Property held by Grantee;

It is now mutually agreed as follows:

- The Grantor hereby conveys, assigns, and transfers all interest in the Property to the Grantee.

- The conveyance is made for the purpose of settling the outstanding debt owed by Grantor to Grantee.

- The Grantor affirms that there are no other liens, demands, or encumbrances on the Property, except as disclosed in writing.

- The Grantor agrees to vacate the Property on or before ________________. This includes removing all personal belongings and concluding any utilities.

- The Grantee accepts the Property in its "as-is" condition, without any warranties or representations.

In witness whereof, the parties hereto have executed this Deed in Lieu of Foreclosure as of the day and year first above written.

______________________________

Grantor's Signature

______________________________

Grantee's Signature

______________________________

Witness Signature

______________________________

Witness Name

STATE OF TEXAS

COUNTY OF ___________________

Before me, the undersigned authority, on this day personally appeared _________________________________, known to me to be the person whose name is subscribed to this instrument, and acknowledged to me that they executed the same for the purposes and considerations therein expressed.

Given under my hand and seal this ____ day of ___________, 20__.

______________________________

Notary Public in and for the State of Texas

My Commission Expires: ________________