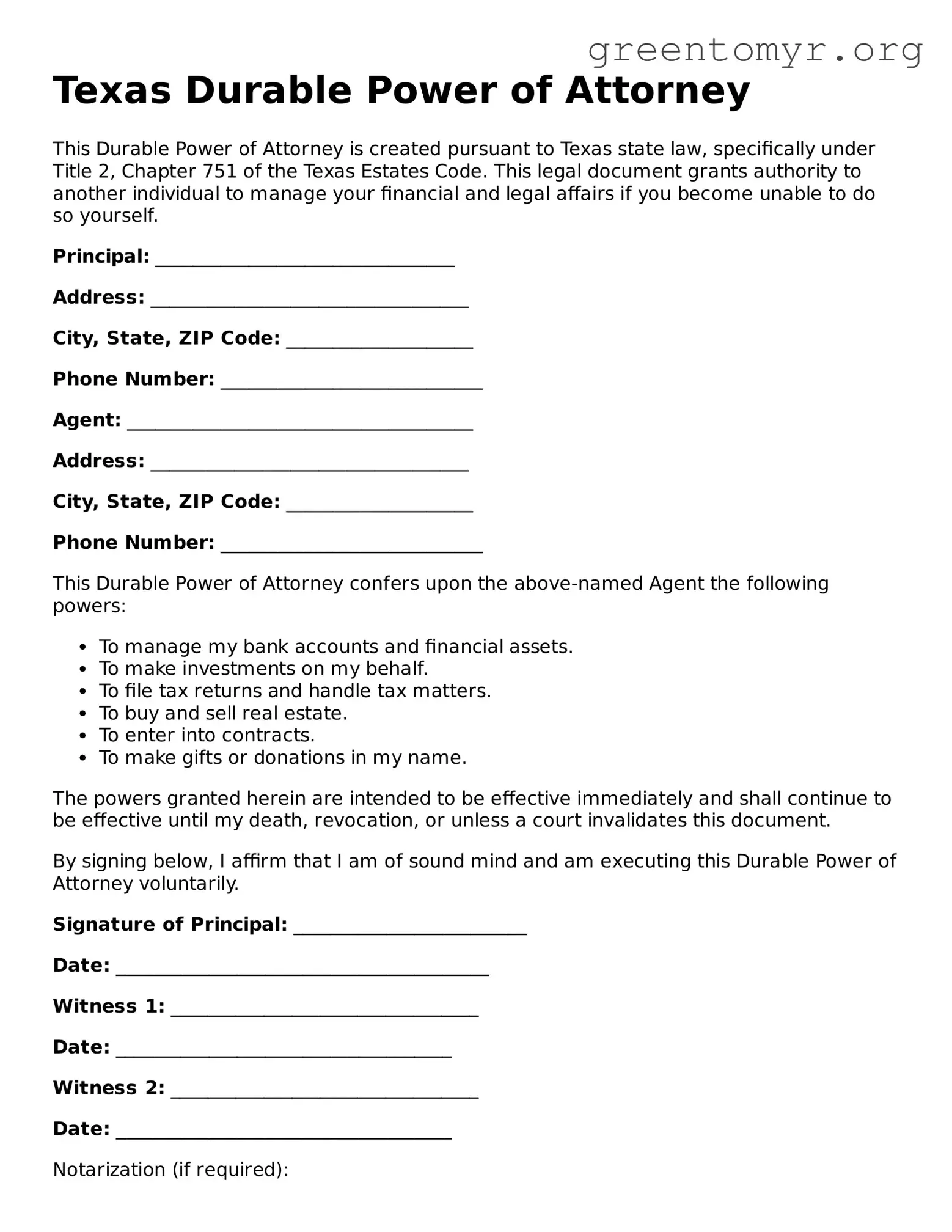

Texas Durable Power of Attorney

This Durable Power of Attorney is created pursuant to Texas state law, specifically under Title 2, Chapter 751 of the Texas Estates Code. This legal document grants authority to another individual to manage your financial and legal affairs if you become unable to do so yourself.

Principal: ________________________________

Address: __________________________________

City, State, ZIP Code: ____________________

Phone Number: ____________________________

Agent: _____________________________________

Address: __________________________________

City, State, ZIP Code: ____________________

Phone Number: ____________________________

This Durable Power of Attorney confers upon the above-named Agent the following powers:

- To manage my bank accounts and financial assets.

- To make investments on my behalf.

- To file tax returns and handle tax matters.

- To buy and sell real estate.

- To enter into contracts.

- To make gifts or donations in my name.

The powers granted herein are intended to be effective immediately and shall continue to be effective until my death, revocation, or unless a court invalidates this document.

By signing below, I affirm that I am of sound mind and am executing this Durable Power of Attorney voluntarily.

Signature of Principal: _________________________

Date: ________________________________________

Witness 1: _________________________________

Date: ____________________________________

Witness 2: _________________________________

Date: ____________________________________

Notarization (if required):

(This section may vary based on your preferences and legal requirements.)

Notary Public Signature: _____________________

My Commission Expires: _____________________