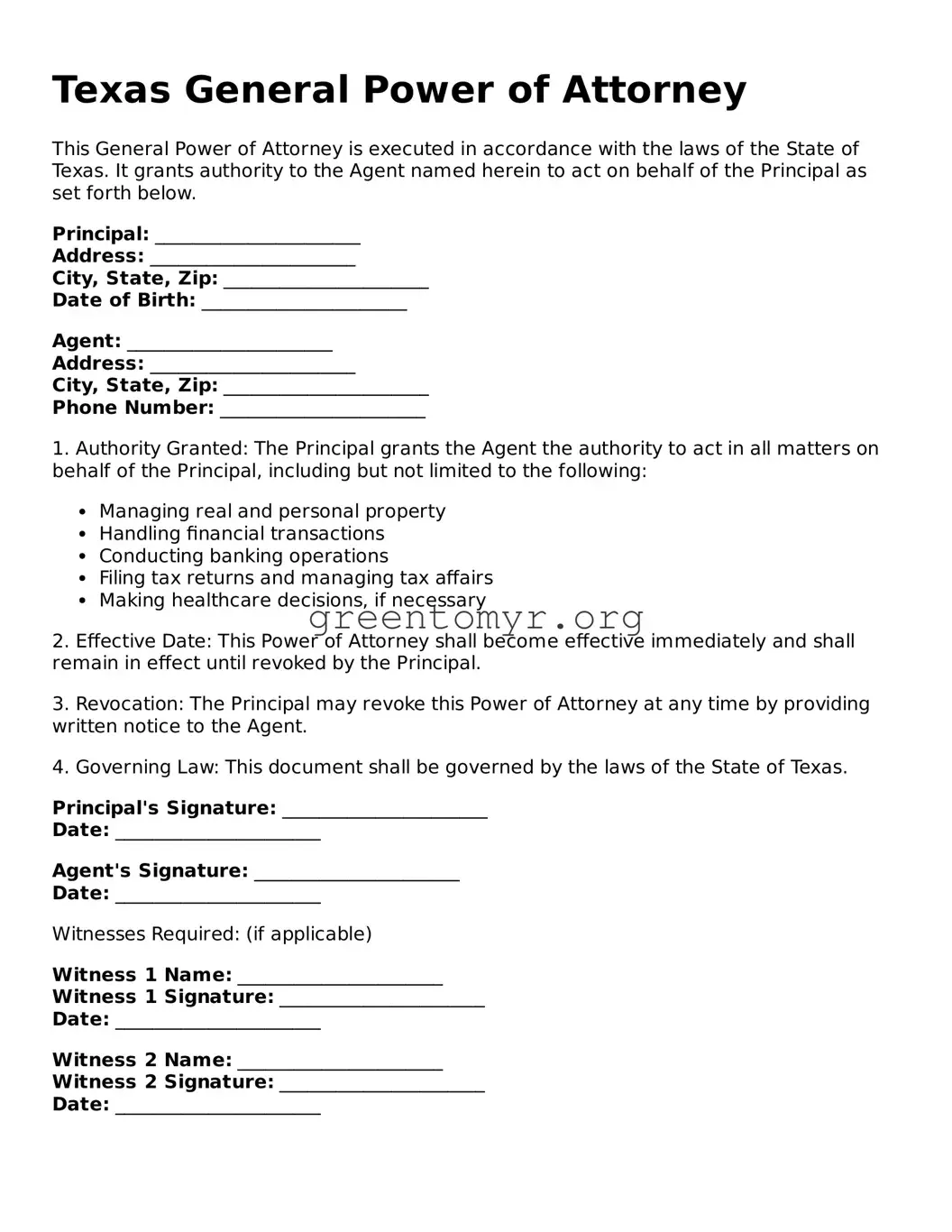

Texas General Power of Attorney

This General Power of Attorney is executed in accordance with the laws of the State of Texas. It grants authority to the Agent named herein to act on behalf of the Principal as set forth below.

Principal: ______________________

Address: ______________________

City, State, Zip: ______________________

Date of Birth: ______________________

Agent: ______________________

Address: ______________________

City, State, Zip: ______________________

Phone Number: ______________________

1. Authority Granted: The Principal grants the Agent the authority to act in all matters on behalf of the Principal, including but not limited to the following:

- Managing real and personal property

- Handling financial transactions

- Conducting banking operations

- Filing tax returns and managing tax affairs

- Making healthcare decisions, if necessary

2. Effective Date: This Power of Attorney shall become effective immediately and shall remain in effect until revoked by the Principal.

3. Revocation: The Principal may revoke this Power of Attorney at any time by providing written notice to the Agent.

4. Governing Law: This document shall be governed by the laws of the State of Texas.

Principal's Signature: ______________________

Date: ______________________

Agent's Signature: ______________________

Date: ______________________

Witnesses Required: (if applicable)

Witness 1 Name: ______________________

Witness 1 Signature: ______________________

Date: ______________________

Witness 2 Name: ______________________

Witness 2 Signature: ______________________

Date: ______________________