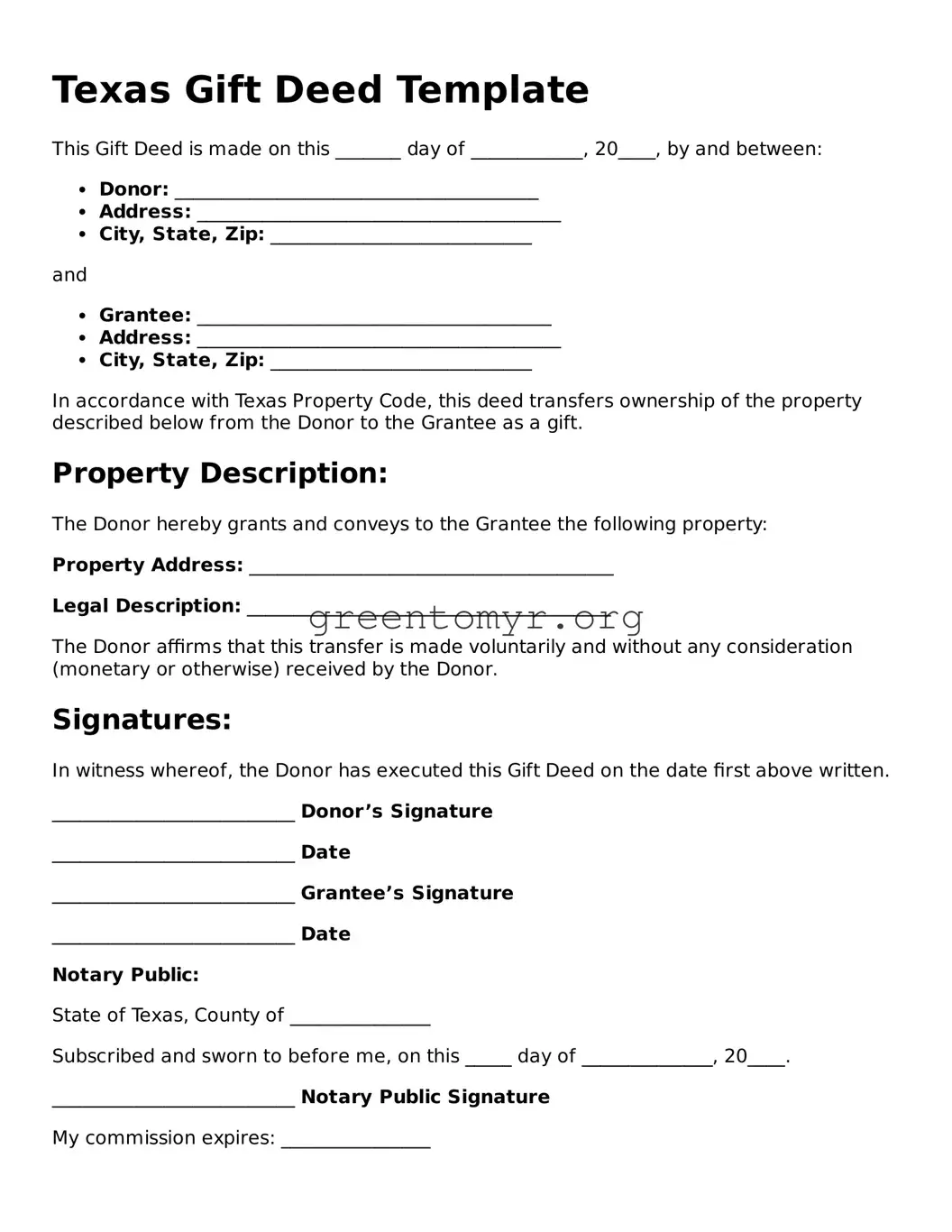

Texas Gift Deed Template

This Gift Deed is made on this _______ day of ____________, 20____, by and between:

- Donor: _______________________________________

- Address: _______________________________________

- City, State, Zip: ____________________________

and

- Grantee: ______________________________________

- Address: _______________________________________

- City, State, Zip: ____________________________

In accordance with Texas Property Code, this deed transfers ownership of the property described below from the Donor to the Grantee as a gift.

Property Description:

The Donor hereby grants and conveys to the Grantee the following property:

Property Address: _______________________________________

Legal Description: _______________________________________

The Donor affirms that this transfer is made voluntarily and without any consideration (monetary or otherwise) received by the Donor.

Signatures:

In witness whereof, the Donor has executed this Gift Deed on the date first above written.

__________________________ Donor’s Signature

__________________________ Date

__________________________ Grantee’s Signature

__________________________ Date

Notary Public:

State of Texas, County of _______________

Subscribed and sworn to before me, on this _____ day of ______________, 20____.

__________________________ Notary Public Signature

My commission expires: ________________