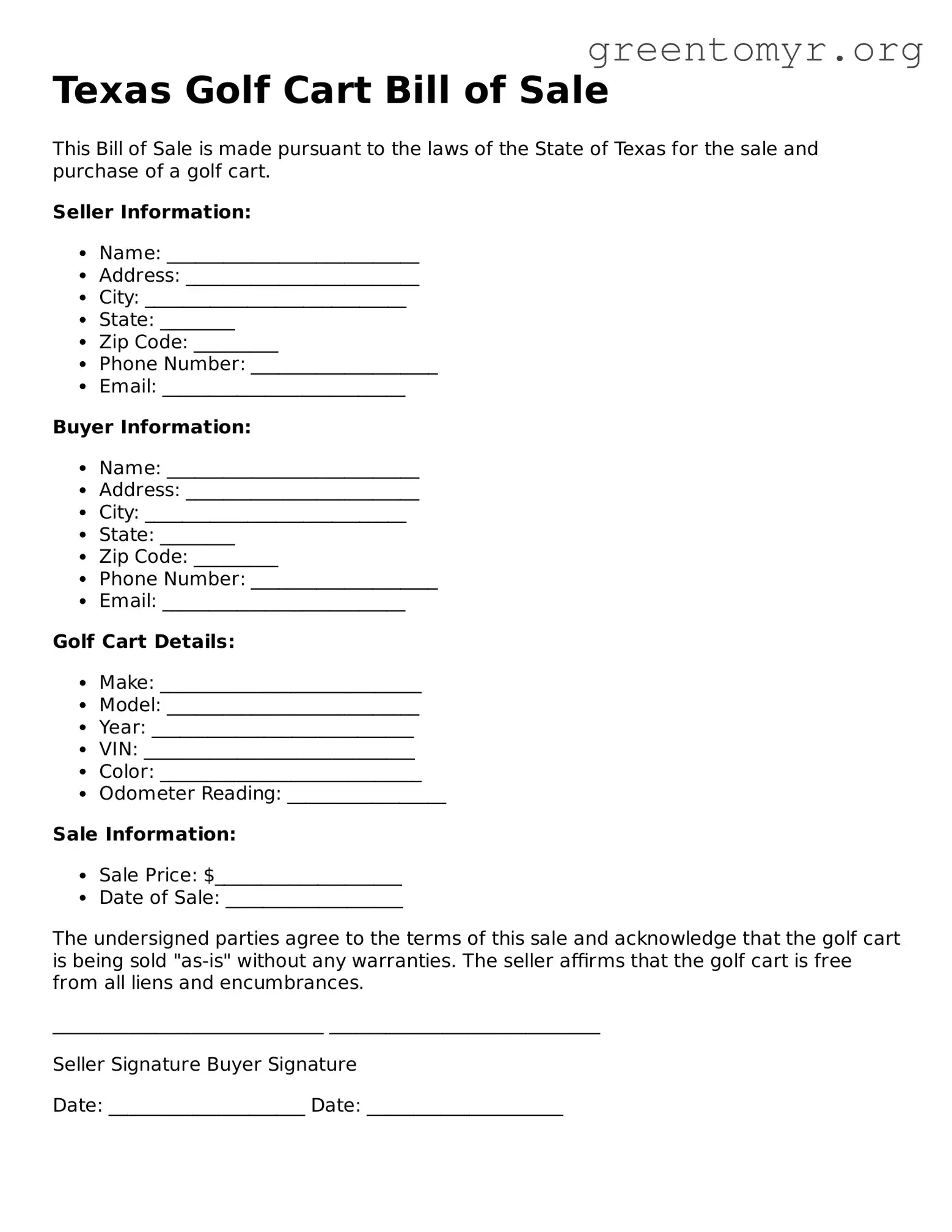

Texas Golf Cart Bill of Sale

This Bill of Sale is made pursuant to the laws of the State of Texas for the sale and purchase of a golf cart.

Seller Information:

- Name: ___________________________

- Address: _________________________

- City: ____________________________

- State: ________

- Zip Code: _________

- Phone Number: ____________________

- Email: __________________________

Buyer Information:

- Name: ___________________________

- Address: _________________________

- City: ____________________________

- State: ________

- Zip Code: _________

- Phone Number: ____________________

- Email: __________________________

Golf Cart Details:

- Make: ____________________________

- Model: ___________________________

- Year: ____________________________

- VIN: _____________________________

- Color: ____________________________

- Odometer Reading: _________________

Sale Information:

- Sale Price: $____________________

- Date of Sale: ___________________

The undersigned parties agree to the terms of this sale and acknowledge that the golf cart is being sold "as-is" without any warranties. The seller affirms that the golf cart is free from all liens and encumbrances.

_____________________________ _____________________________

Seller Signature Buyer Signature

Date: _____________________ Date: _____________________