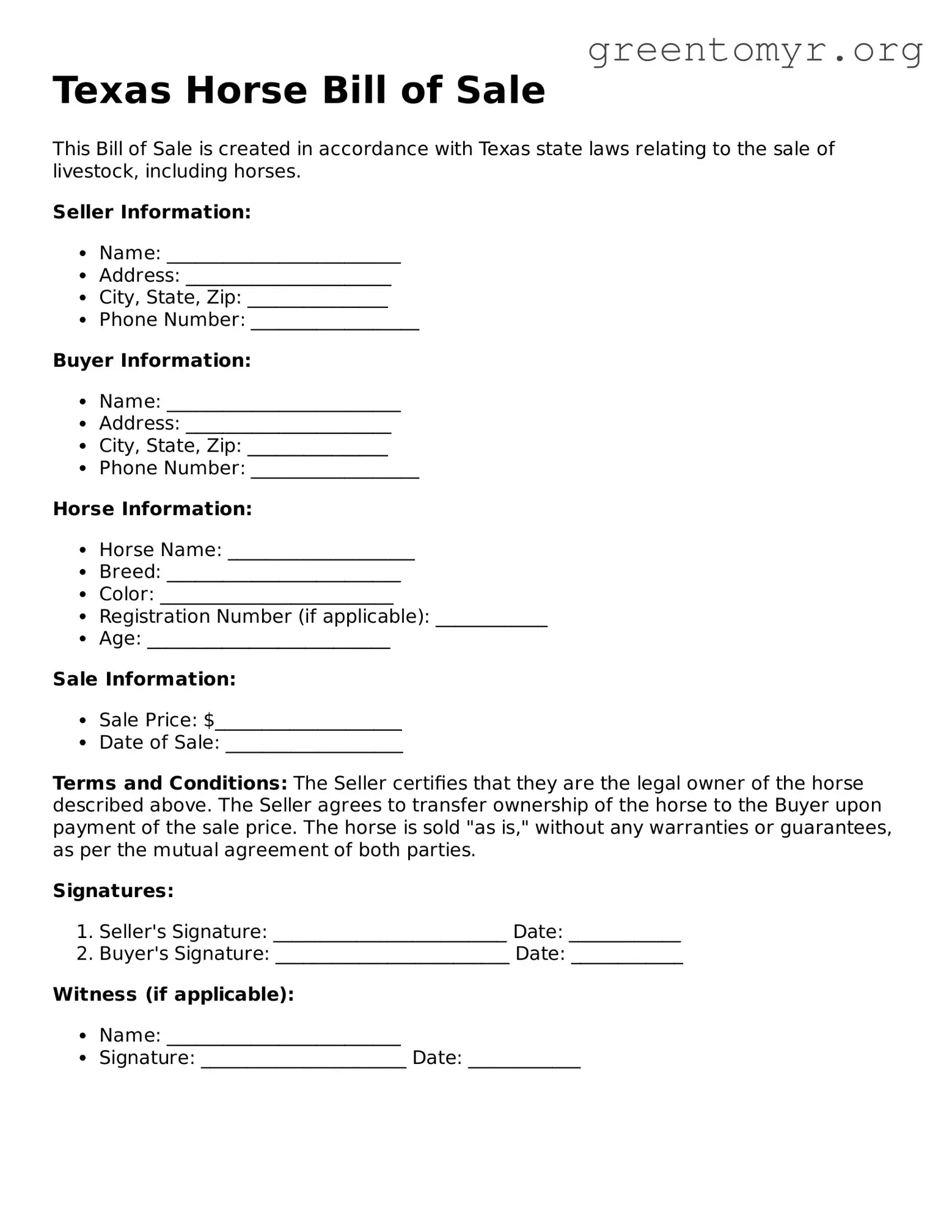

When it comes to filling out the Texas Horse Bill of Sale form, many individuals inadvertently make mistakes that can lead to complications or misunderstandings in a sale. One of the most common mistakes occurs when buyers and sellers fail to provide complete and accurate descriptions of the horse. A vague description can lead to disputes over the animal’s identity and its associated attributes.

Another frequent oversight is neglecting to include the purchase price. It is essential to clearly state the amount being paid for the horse to avoid any confusion or disagreements later on. Failing to include this crucial detail can complicate matters if there are questions about the transaction or if legal issues arise.

Users also often forget to include the date of the sale. This date is significant for various reasons, including the potential establishment of liability and ownership changes. Without a written record of the date, both parties may encounter problems, especially if there are disagreements that occur down the line.

Moreover, some individuals overlook the importance of not obtaining signatures from both the buyer and the seller. A bill of sale is a legally binding document, and if it is unsigned by one party, it is difficult to enforce. Therefore, ensuring that both parties sign the document is essential for maintaining clarity and legitimacy.

Another commonly made mistake is failing to retain copies of the signed form. After signing the document, both parties should keep a copy for their records. This step serves as proof of the transaction and provides vital information if any issues arise in the future.

Incorrectly identifying the horse’s breed or registration number can lead to misunderstandings, particularly if the buyer wishes to compete or register the horse elsewhere. Being thorough and accurate when detailing these aspects is crucial for a valid and effective transaction.

Occasionally, sellers neglect to disclose any known defects or health issues of the horse. This lack of transparency can lead to heavy repercussions, including legal liability. It is in everyone's best interest to be upfront about a horse’s condition at the time of sale.

Some people also rush through the process, attempting to complete the bill of sale without thoroughly reviewing it. Taking the time to verify each section and ensure all relevant information is present can prevent many future complications and disputes.

Another mistake involves using a template that may not fully align with Texas laws or specific requirements. Each state has its own regulations regarding horse sales, and misapplying a template can lead to legal issues. Researching and using an official form suitable for Texas is imperative.

Finally, last-minute changes or edits to the bill of sale, especially if done hastily, can create issues of authenticity and intention. It is advisable to review all changes carefully and ensure that both parties clearly understand and agree to any modifications made before signing.