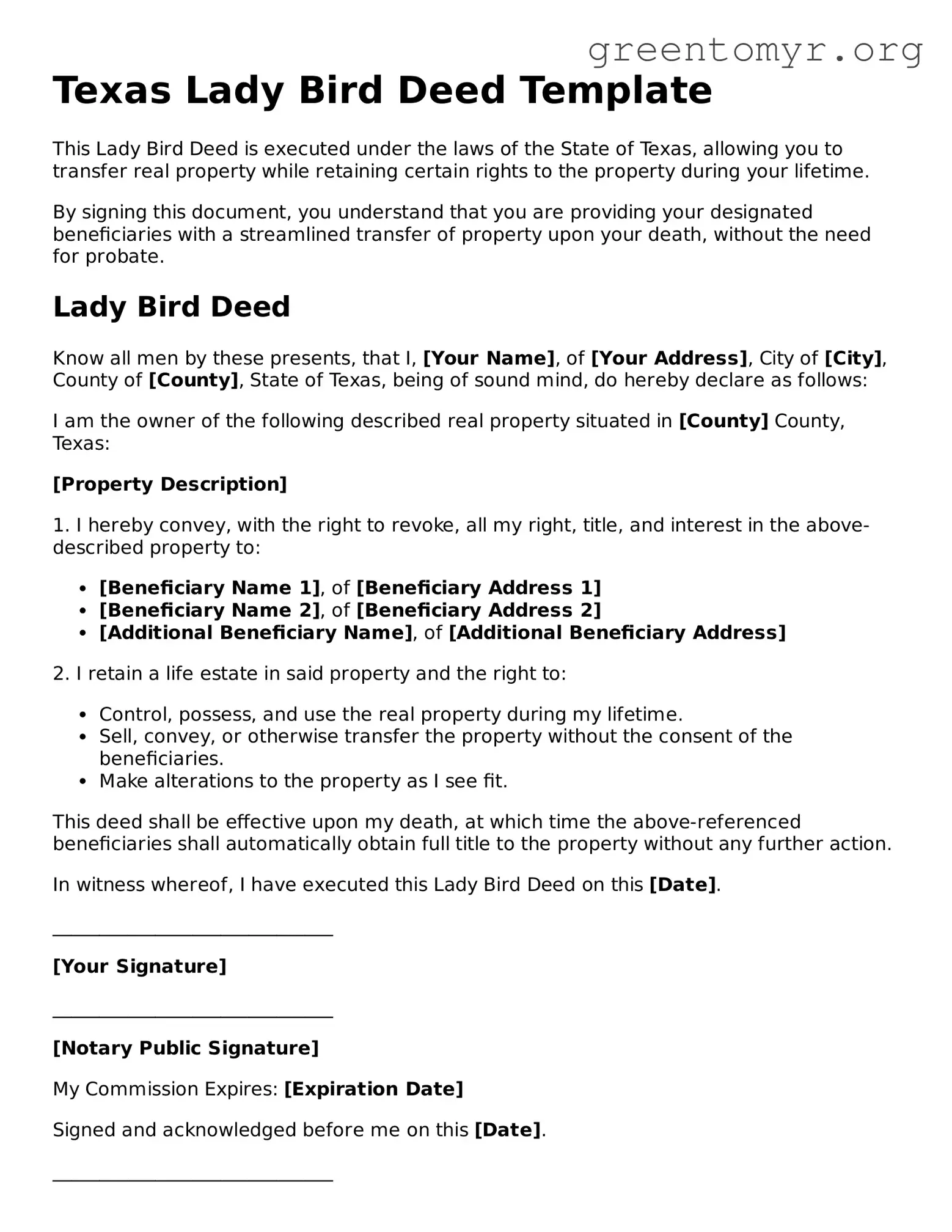

Texas Lady Bird Deed Template

This Lady Bird Deed is executed under the laws of the State of Texas, allowing you to transfer real property while retaining certain rights to the property during your lifetime.

By signing this document, you understand that you are providing your designated beneficiaries with a streamlined transfer of property upon your death, without the need for probate.

Lady Bird Deed

Know all men by these presents, that I, [Your Name], of [Your Address], City of [City], County of [County], State of Texas, being of sound mind, do hereby declare as follows:

I am the owner of the following described real property situated in [County] County, Texas:

[Property Description]

1. I hereby convey, with the right to revoke, all my right, title, and interest in the above-described property to:

- [Beneficiary Name 1], of [Beneficiary Address 1]

- [Beneficiary Name 2], of [Beneficiary Address 2]

- [Additional Beneficiary Name], of [Additional Beneficiary Address]

2. I retain a life estate in said property and the right to:

- Control, possess, and use the real property during my lifetime.

- Sell, convey, or otherwise transfer the property without the consent of the beneficiaries.

- Make alterations to the property as I see fit.

This deed shall be effective upon my death, at which time the above-referenced beneficiaries shall automatically obtain full title to the property without any further action.

In witness whereof, I have executed this Lady Bird Deed on this [Date].

______________________________

[Your Signature]

______________________________

[Notary Public Signature]

My Commission Expires: [Expiration Date]

Signed and acknowledged before me on this [Date].

______________________________

[Notary Public Name]

[Notary Seal]