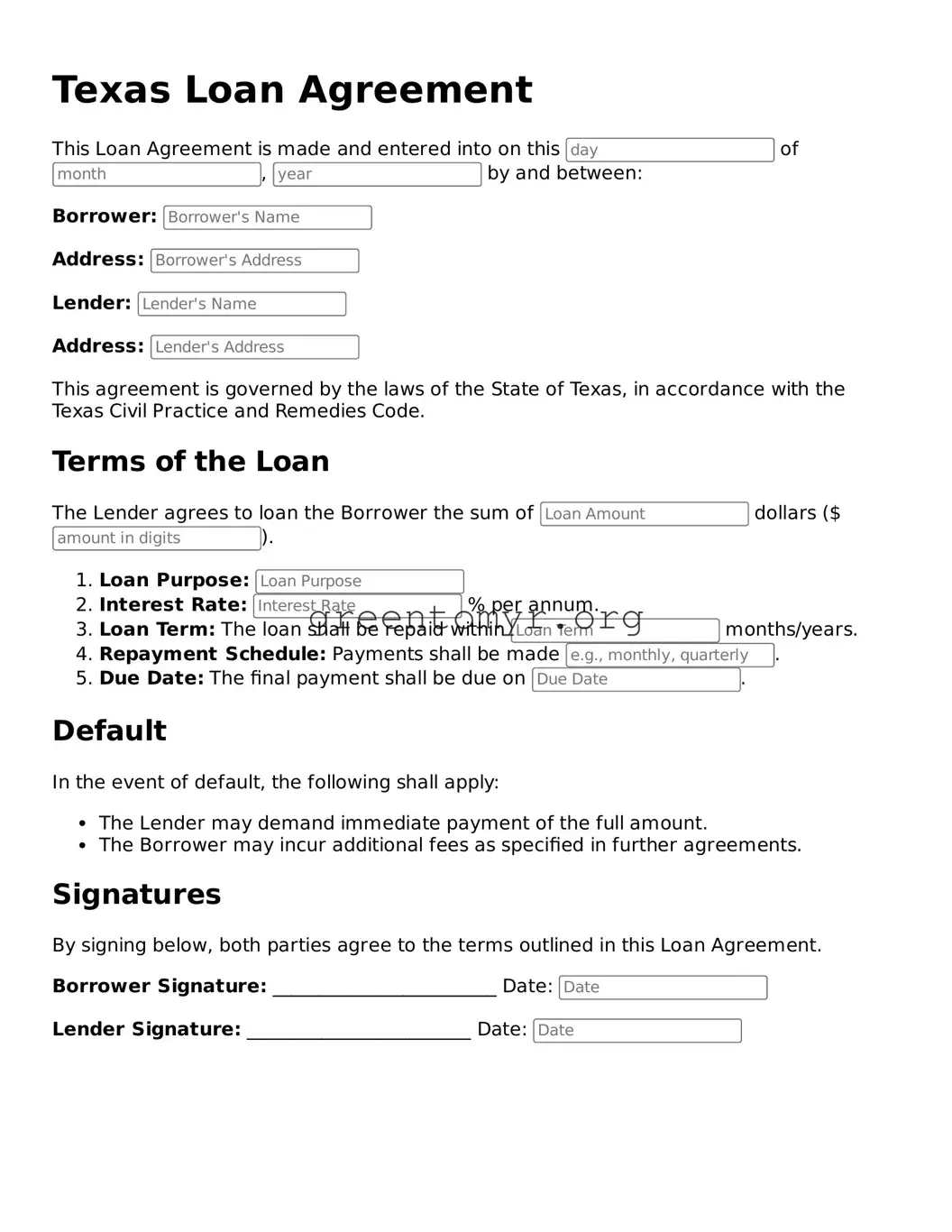

A Texas Loan Agreement form is a legal document used to formalize a loan between a lender and a borrower in the state of Texas. This form outlines the terms of the loan, including the principal amount, interest rates, payment schedule, and consequences for default. Creating a clear written agreement helps protect both parties by ensuring everyone understands their rights and obligations.

Who needs a Texas Loan Agreement?

If you are lending money to someone or borrowing money, it is wise to have a Texas Loan Agreement in place. This document is essential for private loans, whether between friends, family members, or business partners. Having a formal agreement minimizes misunderstandings and can prevent potential legal issues down the line.

What are the key components of the Texas Loan Agreement?

Typically, a Texas Loan Agreement includes several vital elements:

-

Loan Amount:

The total sum of money being lent.

-

Interest Rate:

The percentage charged on the principal amount, often expressed annually.

-

Repayment Terms:

Specific details on how and when payments should be made, including due dates and methods of payment.

-

Default Clauses:

The consequences if the borrower fails to repay the loan as agreed.

-

Signatures:

Both parties should sign the document to validate the agreement.

Do loan agreements need to be notarized in Texas?

In Texas, a loan agreement does not generally require notarization. However, having the document notarized can add an extra layer of protection and credibility, especially in larger loan amounts or transactions involving multiple parties. Ultimately, it may depend on the preferences of the lender and borrower.

Are there limits to the amount that can be loaned?

Generally, there are no specific limits on the amount of money that can be loaned between private parties in Texas. However, lenders should be cautious about predatory lending practices and adhere to federal and state regulations regarding interest rates and lending. It’s also wise for borrowers to ensure they can comfortably repay the amount they are borrowing.

Can a Texas Loan Agreement be modified after it's signed?

Yes, a Texas Loan Agreement can be modified after it’s signed, but both parties must agree to the changes. It’s best to document any modifications in writing and have both parties sign to avoid any confusion later. This can include altering payment terms or extending the loan duration.

What happens if the borrower defaults on the loan?

If a borrower defaults on the loan—essentially failing to make the required payments—the lender has several options. These may include:

-

Negotiating a repayment plan or settlement.

-

Charging late payment fees as specified in the agreement.

-

Pursuing legal action to recover the debt if necessary.

By defining default conditions in the original agreement, both parties are clear about the next steps should this situation arise. Always remember that communication is key to resolving issues amicably.