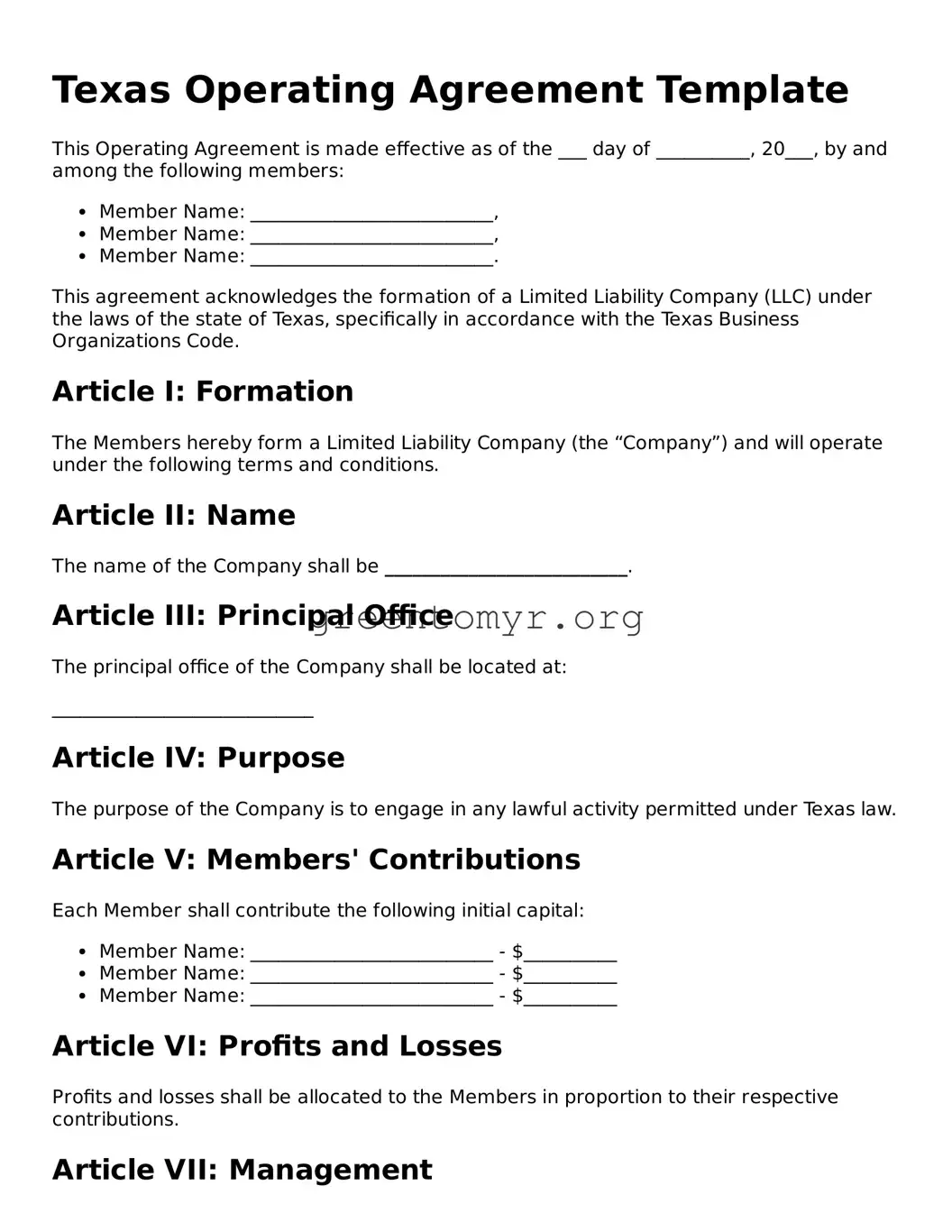

Texas Operating Agreement Template

This Operating Agreement is made effective as of the ___ day of __________, 20___, by and among the following members:

- Member Name: __________________________,

- Member Name: __________________________,

- Member Name: __________________________.

This agreement acknowledges the formation of a Limited Liability Company (LLC) under the laws of the state of Texas, specifically in accordance with the Texas Business Organizations Code.

Article I: Formation

The Members hereby form a Limited Liability Company (the “Company”) and will operate under the following terms and conditions.

Article II: Name

The name of the Company shall be __________________________.

Article III: Principal Office

The principal office of the Company shall be located at:

____________________________

Article IV: Purpose

The purpose of the Company is to engage in any lawful activity permitted under Texas law.

Article V: Members' Contributions

Each Member shall contribute the following initial capital:

- Member Name: __________________________ - $__________

- Member Name: __________________________ - $__________

- Member Name: __________________________ - $__________

Article VI: Profits and Losses

Profits and losses shall be allocated to the Members in proportion to their respective contributions.

Article VII: Management

The Company is managed by its Members. Decisions shall require a majority vote unless otherwise specified.

Article VIII: Meetings

- Regular meetings shall occur at least annually.

- Special meetings may be called by any Member.

- Notice of meetings must be provided at least ____ days in advance.

Article IX: Indemnification

The Company shall indemnify Members against any losses incurred due to the Company’s activities, provided the Members acted in good faith.

Article X: Amendments

This Operating Agreement may be amended only by a written agreement signed by all Members.

Signatures

By signing below, the Members agree to the terms of this Operating Agreement:

__________________________ (Member Signature)

Date: ________________________

__________________________ (Member Signature)

Date: ________________________

__________________________ (Member Signature)

Date: ________________________