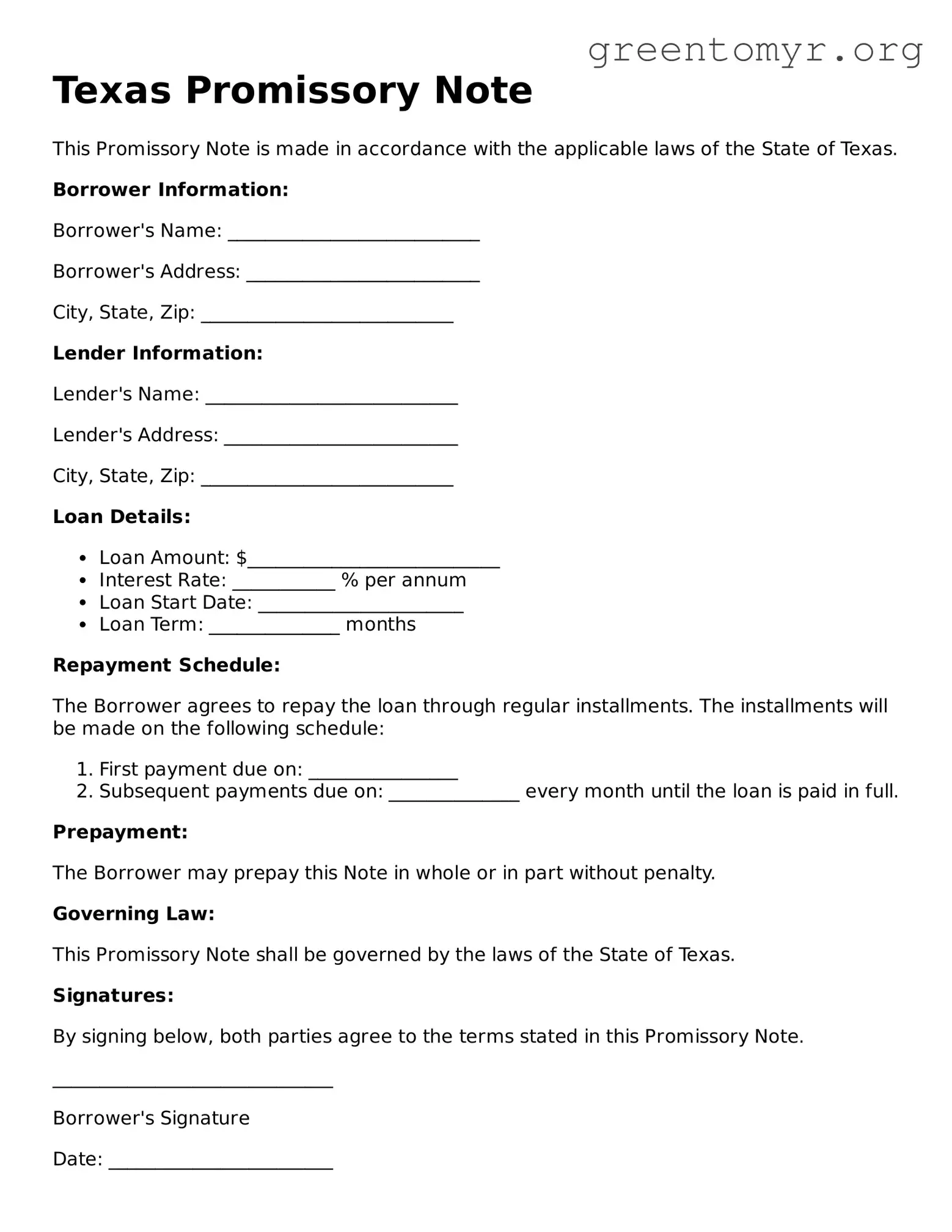

Texas Promissory Note

This Promissory Note is made in accordance with the applicable laws of the State of Texas.

Borrower Information:

Borrower's Name: ___________________________

Borrower's Address: _________________________

City, State, Zip: ___________________________

Lender Information:

Lender's Name: ___________________________

Lender's Address: _________________________

City, State, Zip: ___________________________

Loan Details:

- Loan Amount: $___________________________

- Interest Rate: ___________ % per annum

- Loan Start Date: ______________________

- Loan Term: ______________ months

Repayment Schedule:

The Borrower agrees to repay the loan through regular installments. The installments will be made on the following schedule:

- First payment due on: ________________

- Subsequent payments due on: ______________ every month until the loan is paid in full.

Prepayment:

The Borrower may prepay this Note in whole or in part without penalty.

Governing Law:

This Promissory Note shall be governed by the laws of the State of Texas.

Signatures:

By signing below, both parties agree to the terms stated in this Promissory Note.

______________________________

Borrower's Signature

Date: ________________________

______________________________

Lender's Signature

Date: ________________________