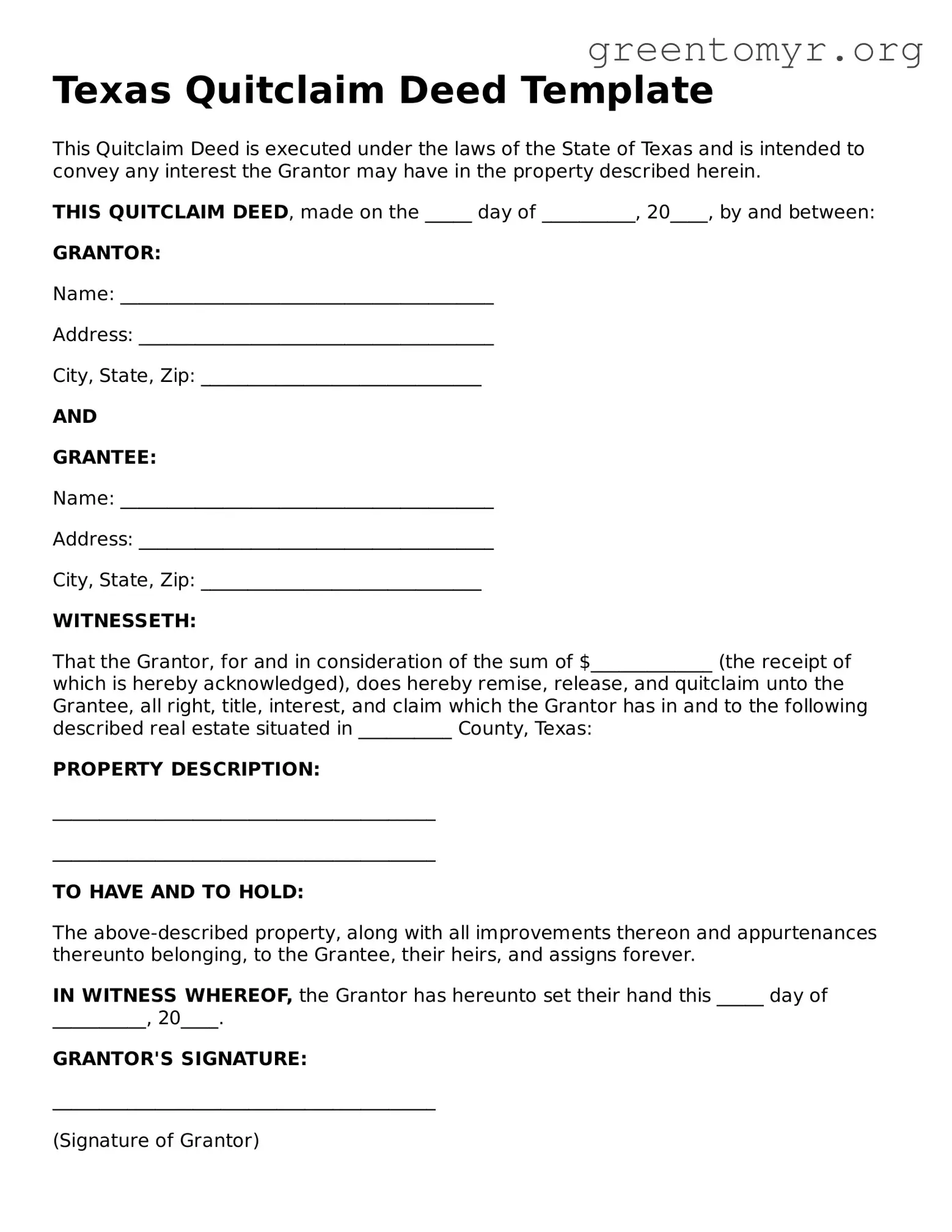

Texas Quitclaim Deed Template

This Quitclaim Deed is executed under the laws of the State of Texas and is intended to convey any interest the Grantor may have in the property described herein.

THIS QUITCLAIM DEED, made on the _____ day of __________, 20____, by and between:

GRANTOR:

Name: ________________________________________

Address: ______________________________________

City, State, Zip: ______________________________

AND

GRANTEE:

Name: ________________________________________

Address: ______________________________________

City, State, Zip: ______________________________

WITNESSETH:

That the Grantor, for and in consideration of the sum of $_____________ (the receipt of which is hereby acknowledged), does hereby remise, release, and quitclaim unto the Grantee, all right, title, interest, and claim which the Grantor has in and to the following described real estate situated in __________ County, Texas:

PROPERTY DESCRIPTION:

_________________________________________

_________________________________________

TO HAVE AND TO HOLD:

The above-described property, along with all improvements thereon and appurtenances thereunto belonging, to the Grantee, their heirs, and assigns forever.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand this _____ day of __________, 20____.

GRANTOR'S SIGNATURE:

_________________________________________

(Signature of Grantor)

NOTARY PUBLIC:

State of Texas

County of ________________

On this _____ day of ___________, 20____, before me, a Notary Public in and for said County and State, personally appeared __________________________________ (Name of Grantor), known to me to be the person whose name is subscribed to the foregoing instrument, and acknowledged that they executed the same for the purposes and considerations therein expressed.

Given under my hand and seal of office this _____ day of ___________, 20____.

_________________________________________

Notary Public, State of Texas

My commission expires: ___________________