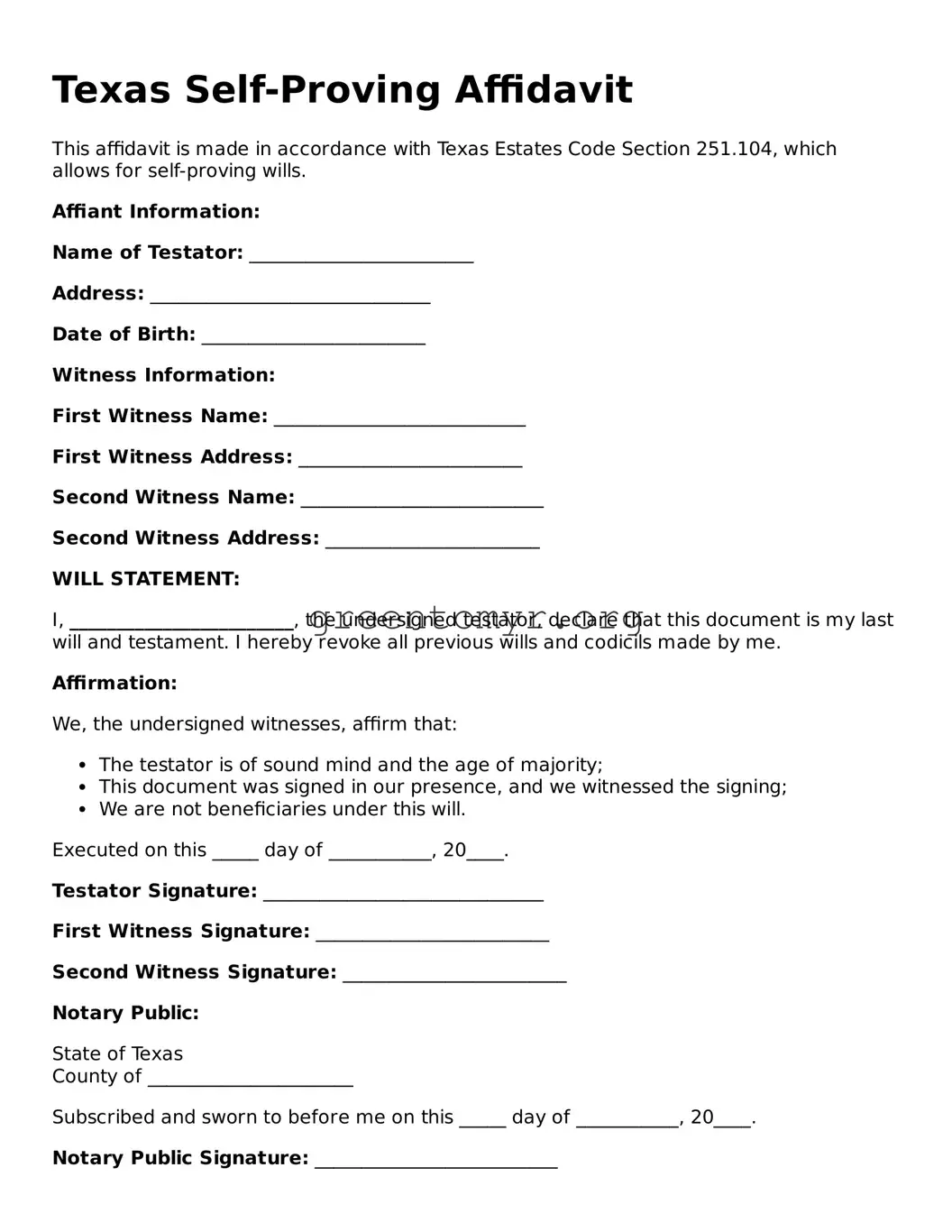

Texas Self-Proving Affidavit

This affidavit is made in accordance with Texas Estates Code Section 251.104, which allows for self-proving wills.

Affiant Information:

Name of Testator: ________________________

Address: ______________________________

Date of Birth: ________________________

Witness Information:

First Witness Name: ___________________________

First Witness Address: ________________________

Second Witness Name: __________________________

Second Witness Address: _______________________

WILL STATEMENT:

I, ________________________, the undersigned testator, declare that this document is my last will and testament. I hereby revoke all previous wills and codicils made by me.

Affirmation:

We, the undersigned witnesses, affirm that:

- The testator is of sound mind and the age of majority;

- This document was signed in our presence, and we witnessed the signing;

- We are not beneficiaries under this will.

Executed on this _____ day of ___________, 20____.

Testator Signature: ______________________________

First Witness Signature: _________________________

Second Witness Signature: ________________________

Notary Public:

State of Texas

County of ______________________

Subscribed and sworn to before me on this _____ day of ___________, 20____.

Notary Public Signature: __________________________

Notary Seal: __________________________________