When filling out the Texas Small Estate Affidavit form, many individuals encounter common pitfalls that can lead to complications later on. One frequent mistake is failing to verify the eligibility criteria for using this form. The law stipulates that an estate must not exceed $75,000 in value, excluding certain assets. Many people mistakenly attempt to use the affidavit for larger estates, which can result in delays and additional legal fees.

Another issue arises with the inclusion of assets. Often, individuals overlook the necessity to compile a complete list of the decedent’s assets. This can include bank accounts, vehicles, and real estate. If a form lists only some assets, it may be deemed incomplete. A thorough inventory is essential to avoid potential disputes among heirs or complications in the probate process.

The third common error involves not providing proper identification. Individuals must attach a copy of the decedent’s death certificate along with the affidavit. Sometimes, people fail to include necessary documentation, which can stall the filing process. It's crucial to ensure all relevant paperwork accompanies the affidavit to support your claims and streamline the procedure.

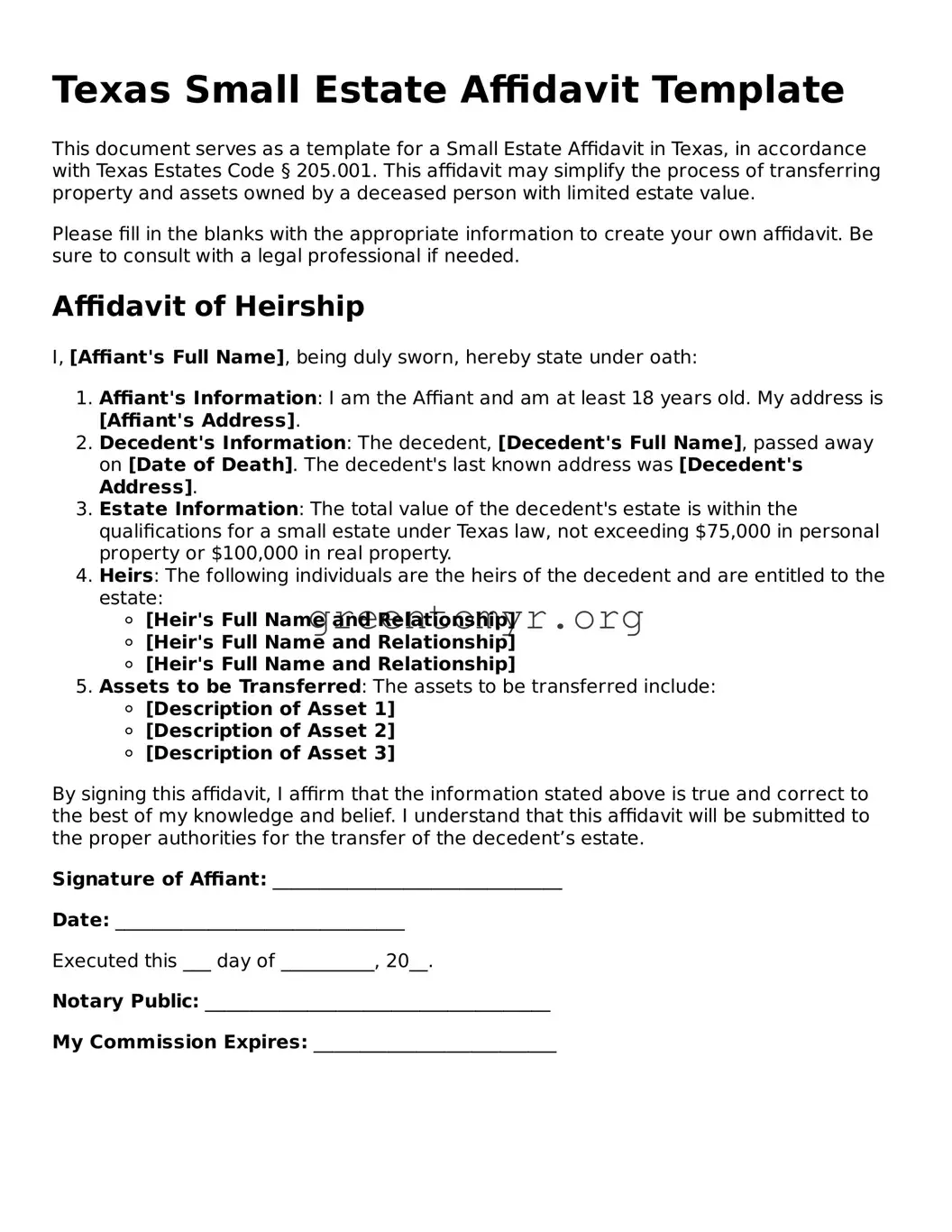

Many filers also neglect the requirement for signatures. The affidavit must be signed by those who are claiming the estate, commonly known as “affiants.” If all qualifying parties do not sign, the affidavit may be rejected. It’s important to gather the required signatures before submitting the form to ensure everyone's agreement and acknowledgment of the estate’s distribution.

Incorrectly certifying the affidavit is another frequent mistake. Affiants must declare that the information provided is true and correct to the best of their knowledge. If this declaration is not entirely accurate, it could lead to legal repercussions. Double-checking all facts and figures before finalizing the affidavit can help prevent unintended consequences.

Individuals sometimes also undervalue or overvalue property on the affidavit. Accurately assessing the market value of assets is vital. If property values are grossly misrepresented, it could affect the validity of the affidavit. Engaging a professional appraiser might be advisable to ensure that valuations reflect current market conditions.

The process can be further complicated by overlooking local requirements. Each county might have specific rules or additional forms to accompany the affidavit. Checking with the local probate court can save time and headaches, as following the precise procedures for your location is vital for acceptance of the affidavit.

Emotional stress can lead to mistakes, particularly when families are grieving. Under pressure, people may rush the process, resulting in careless errors. Taking the time to carefully review the affidavit, possibly with the assistance of a knowledgeable friend or legal advisor, can help ensure that the document is completed accurately.

Lastly, many fail to file the affidavit in a timely manner. There are deadlines associated with probate processes, and delays can exacerbate issues among heirs. Understanding and adhering to these important timelines becomes critical in the successful execution of estate matters.