What is a Texas Tractor Bill of Sale?

A Texas Tractor Bill of Sale is a legal document used to record the sale and purchase of a tractor within the state of Texas. This form outlines details regarding the tractor being sold, along with information about both the seller and the buyer. It serves as proof that the transfer of ownership has occurred.

Why do I need a Bill of Sale for my tractor?

A Bill of Sale is important for several reasons:

-

It provides evidence of the transaction.

-

It records the sale price and any terms agreed upon by both parties.

-

It helps in transferring the title to the new owner.

-

Some state authorities may require it for registration or tax purposes.

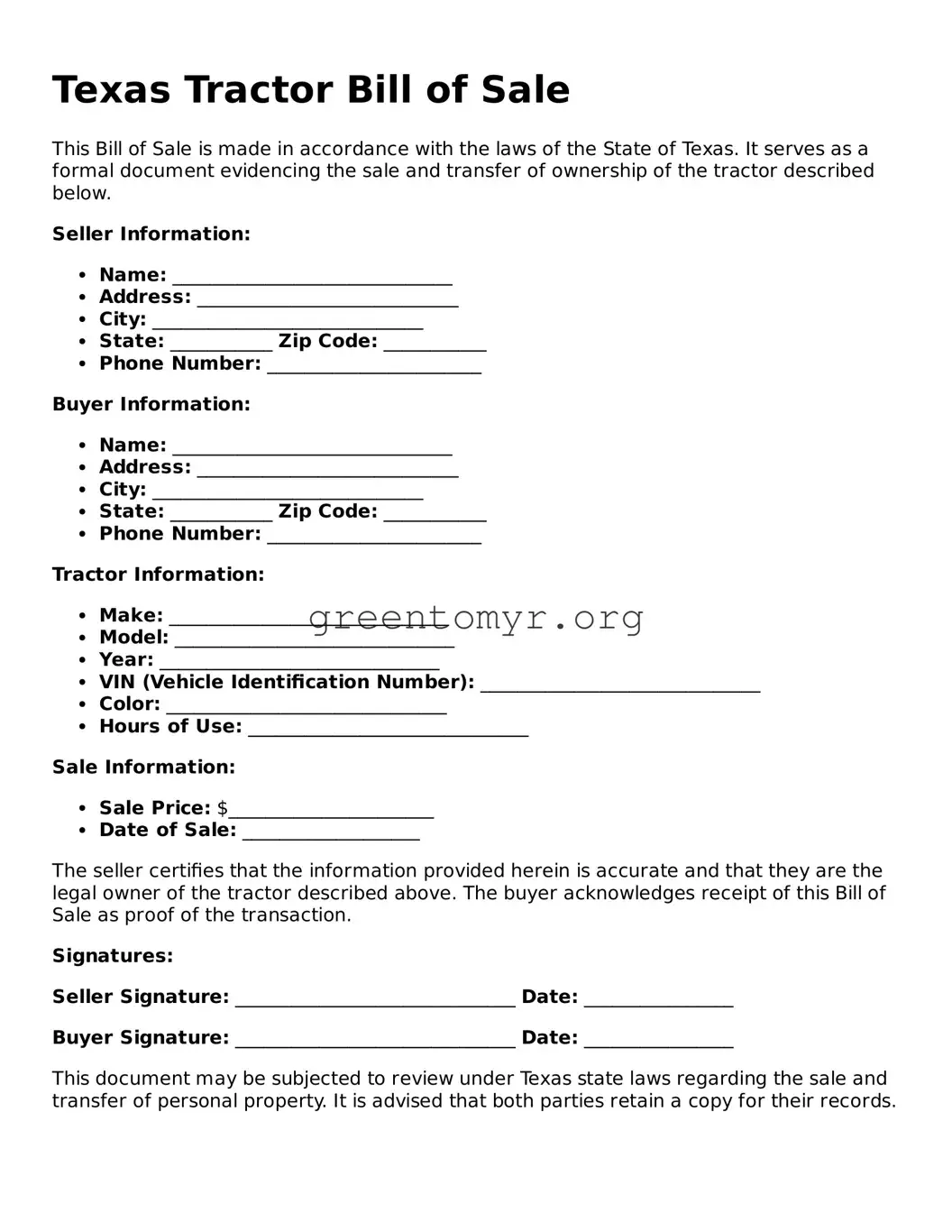

Typically, a Texas Tractor Bill of Sale will include:

-

The names and addresses of the seller and buyer.

-

A description of the tractor, including the make, model, and year.

-

The Vehicle Identification Number (VIN).

-

The sale price of the tractor.

-

The date of the transaction.

-

Signatures of both parties.

Do I need to notarize the Bill of Sale?

In Texas, notarization is not required for a Bill of Sale to be valid. However, having the document notarized can provide an extra layer of protection and can be beneficial if any disputes arise in the future.

Can I use a Bill of Sale template?

Yes, many people use Bill of Sale templates to simplify the process. Templates can be found online, but it’s important to ensure that the template adheres to Texas state requirements. Customizing the template to accurately reflect the details of the sale is essential.

Is a Bill of Sale the same as a title transfer?

No, a Bill of Sale and a title transfer are not the same. The Bill of Sale serves to document the sale, while the title is the official document that proves ownership of the tractor. In Texas, you must complete the title transfer process with the Texas Department of Motor Vehicles (DMV) after completing the sale.

What if the tractor is a gift?

If you are giving a tractor as a gift rather than selling it, you can still use a Bill of Sale. Adjust the details to reflect that the tractor is a gift, including indicating that no money is exchanged. It’s still advisable to document the transaction for clarity and legal purposes.

What happens if the tractor is financed?

If the tractor is financed, you will need to settle any outstanding loans before transferring ownership. Ensure that the lien is released or the loan is paid off, as the lender has a claim to the tractor until the debt is resolved. Taking these steps ensures a smooth transfer of ownership.

Where can I obtain a Texas Tractor Bill of Sale?

Texas Tractor Bill of Sale forms can be found at various sources:

-

Online legal document services.

-

Local motor vehicle offices.

-

Some tractor dealerships may provide their own forms.

-

Various websites that offer printable forms specific to Texas.