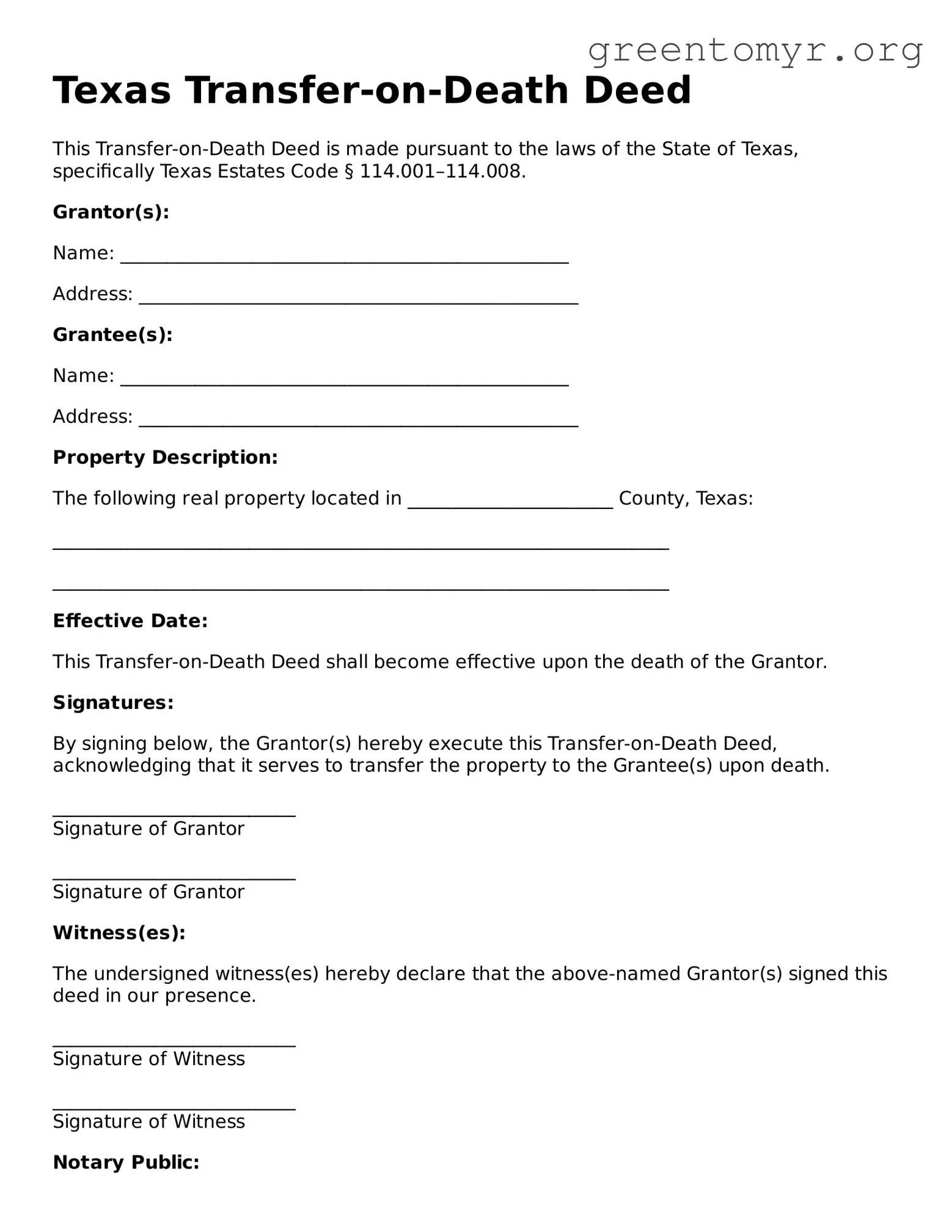

Texas Transfer-on-Death Deed

This Transfer-on-Death Deed is made pursuant to the laws of the State of Texas, specifically Texas Estates Code § 114.001–114.008.

Grantor(s):

Name: ________________________________________________

Address: _______________________________________________

Grantee(s):

Name: ________________________________________________

Address: _______________________________________________

Property Description:

The following real property located in ______________________ County, Texas:

__________________________________________________________________

__________________________________________________________________

Effective Date:

This Transfer-on-Death Deed shall become effective upon the death of the Grantor.

Signatures:

By signing below, the Grantor(s) hereby execute this Transfer-on-Death Deed, acknowledging that it serves to transfer the property to the Grantee(s) upon death.

__________________________

Signature of Grantor

__________________________

Signature of Grantor

Witness(es):

The undersigned witness(es) hereby declare that the above-named Grantor(s) signed this deed in our presence.

__________________________

Signature of Witness

__________________________

Signature of Witness

Notary Public:

State of Texas

County of ________________

Subscribed and sworn to me before this ____ day of ______________, 20__.

__________________________

Notary Public, State of Texas

My Commission Expires: ____________