When filling out the TMRS direct deposit authorization form, many individuals unintentionally make common mistakes. Committing even one of these errors can delay the processing of your request or even lead to misdirected funds. Understanding these pitfalls is crucial for ensuring a smooth transition to direct deposit.

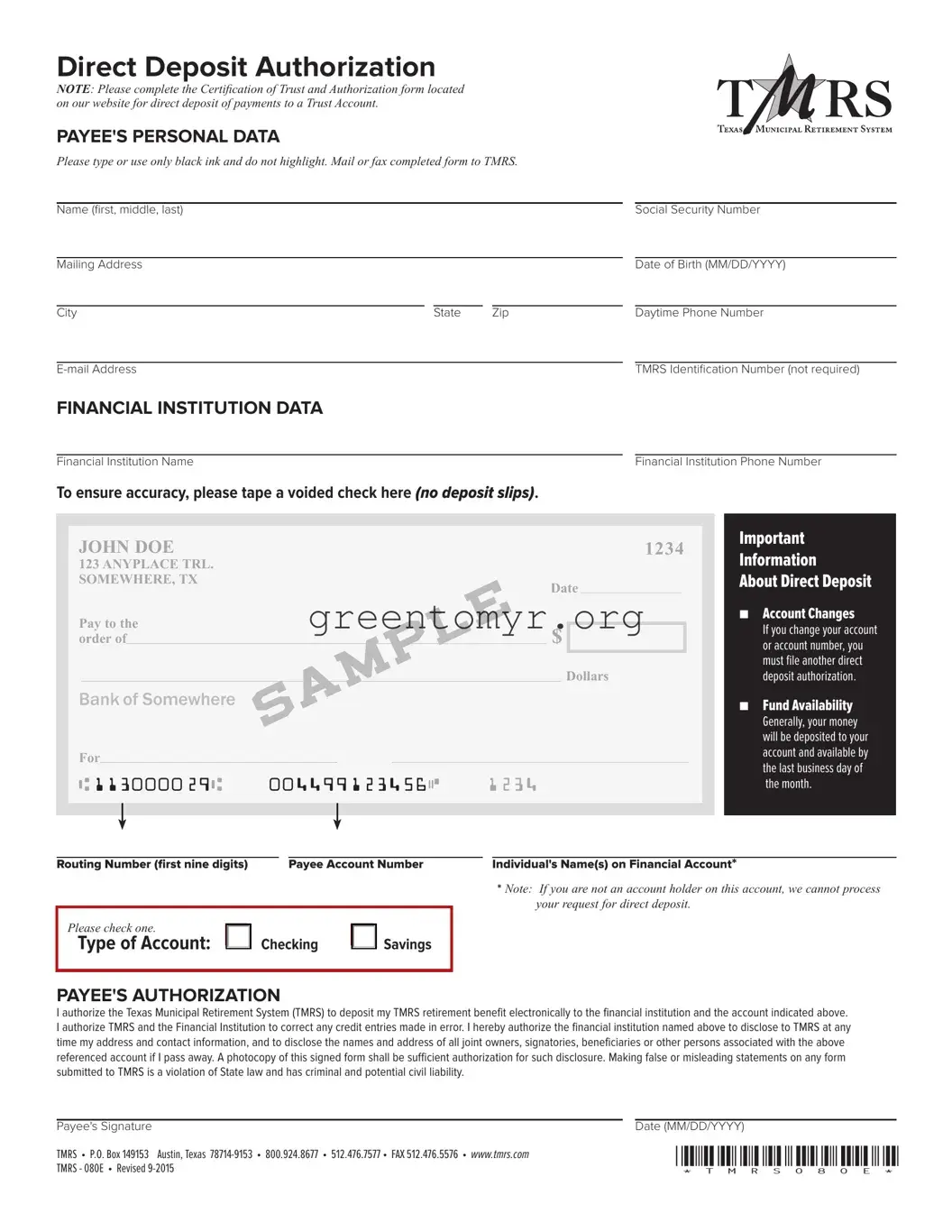

One significant mistake is providing incomplete personal information. If required fields, such as your name or Social Security number, are left blank, the form is likely to be rejected. Always double-check that all necessary information is included.

Another frequent error is misunderstanding the bank account details. Ensure you fill in the correct account number and routing number. A single digit off can mean funds end up in the wrong account. It’s advisable to review these numbers with your bank to confirm accuracy before submission.

Some people also overlook the importance of signatures. Forgetting to sign the form or using a signature that doesn’t match the bank records can halt the authorization process. Signatures are not just formality; they verify that you consent to the terms of direct deposit.

In addition, assuming that a copy of the form is sufficient can lead to misunderstanding. It’s vital to submit the original signed authorization form unless instructed otherwise. Copies may not be accepted by the TMRS, potentially delaying your payments.

A common oversight is neglecting to update prior information. If you have previously submitted a direct deposit form, ensure that the new submission reflects any recent changes, such as a recent bank account switch. Older forms may still be in effect if not canceled, causing confusion.

People sometimes fail to review the payment schedule. Knowing when you will receive your deposits is essential for budgeting and financial planning. If the authorization form is submitted late, payments may not occur on time. Understanding the timing allows you to better manage your finances during the transition.

Another mistake is ignoring the additional requirements stated on the form. Some individuals assume that submitting just the form is sufficient, but additional documents, like a voided check or bank letter, may be needed. Pay close attention to any instructions that accompany the authorization form.

Finally, many are unaware of contacting customer service for clarification. If anything about the form is confusing, it's wise to reach out for assistance rather than guess. Misinterpretations can lead to errors that are easily avoidable through simple clarification.

By being mindful of these mistakes, individuals can significantly improve their experience with the TMRS direct deposit authorization process. Proper preparation and attention to detail will lead to a smoother financial transaction for all involved.