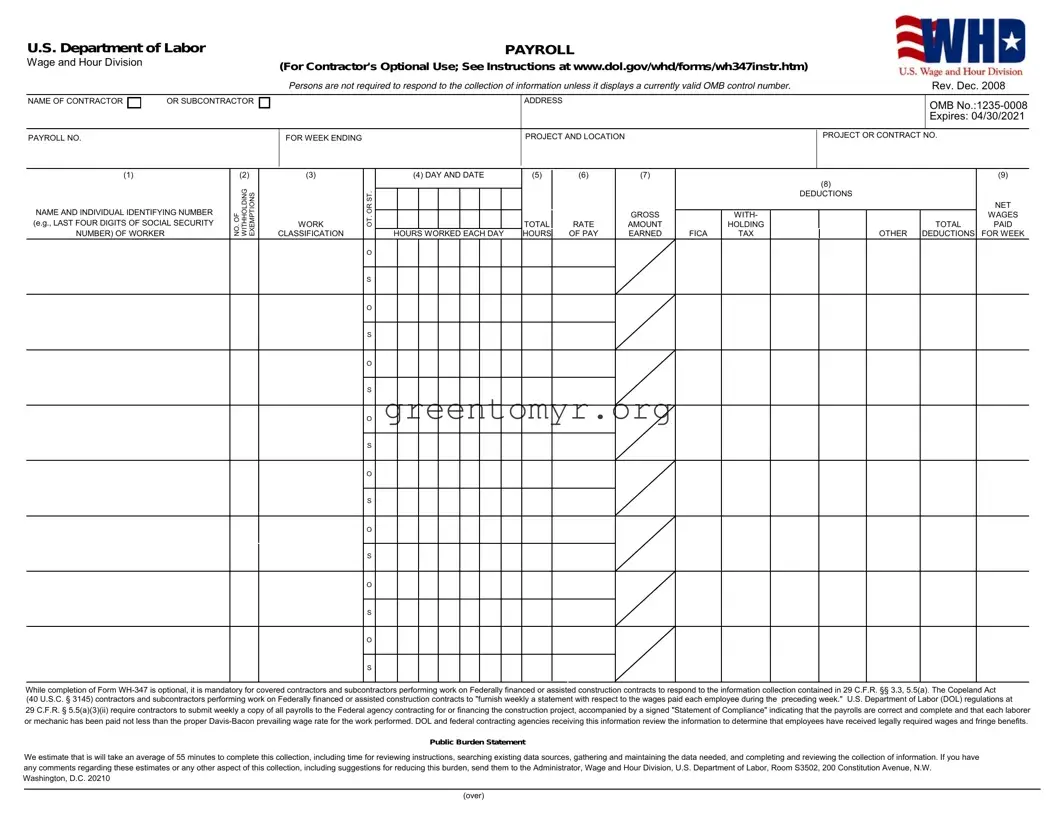

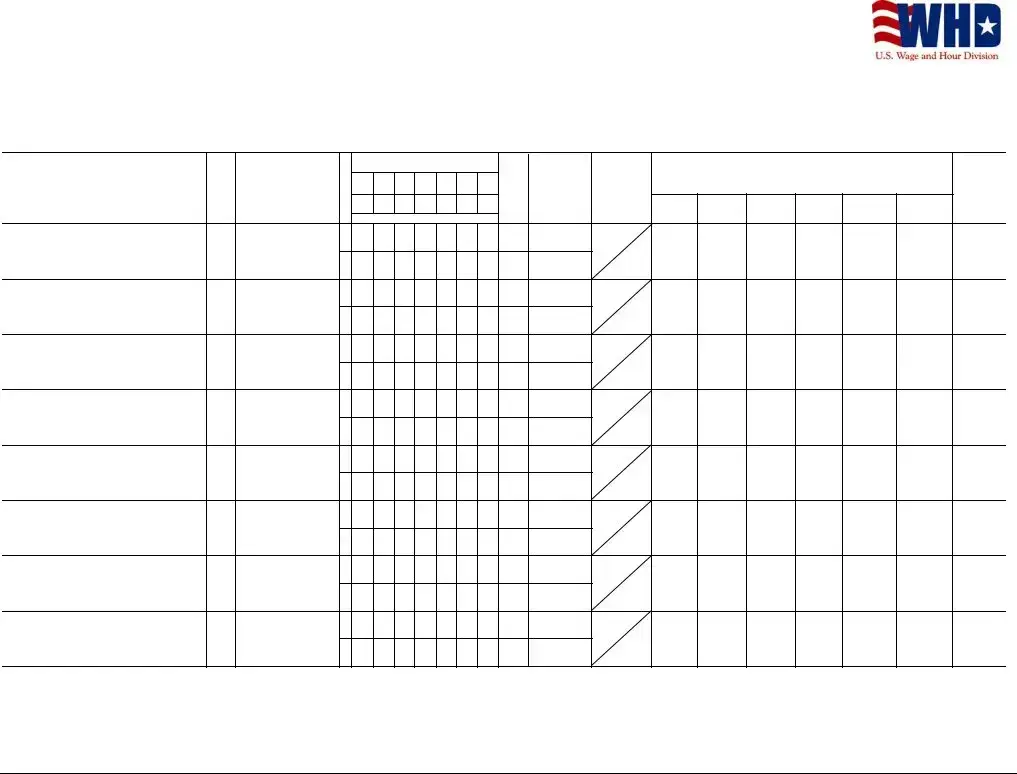

Filling out the U.S. Department of Labor (DoL) form can often feel like navigating a maze. It's easy to make mistakes, especially when you're trying to ensure everything is accurate and complete. One common error is leaving blank fields. Each section of the form is essential, and omitting any information can lead to delays or even a rejection. Always double-check that every applicable space is filled in completely.

Another common pitfall involves incorrect dates. Many people underestimate the importance of providing precise dates on the form. Errors in dates can create confusion and possibly invalidate the submission. Make sure to keep a calendar handy and verify that each date corresponds to your timeline accurately.

Filling out the form with vague descriptions is another frequent blunder. Specificity is key when detailing your employment history or reason for filing. Instead of using general phrases, describe your roles and responsibilities in clear terms. This provides a better understanding and helps avoid delays in processing your application.

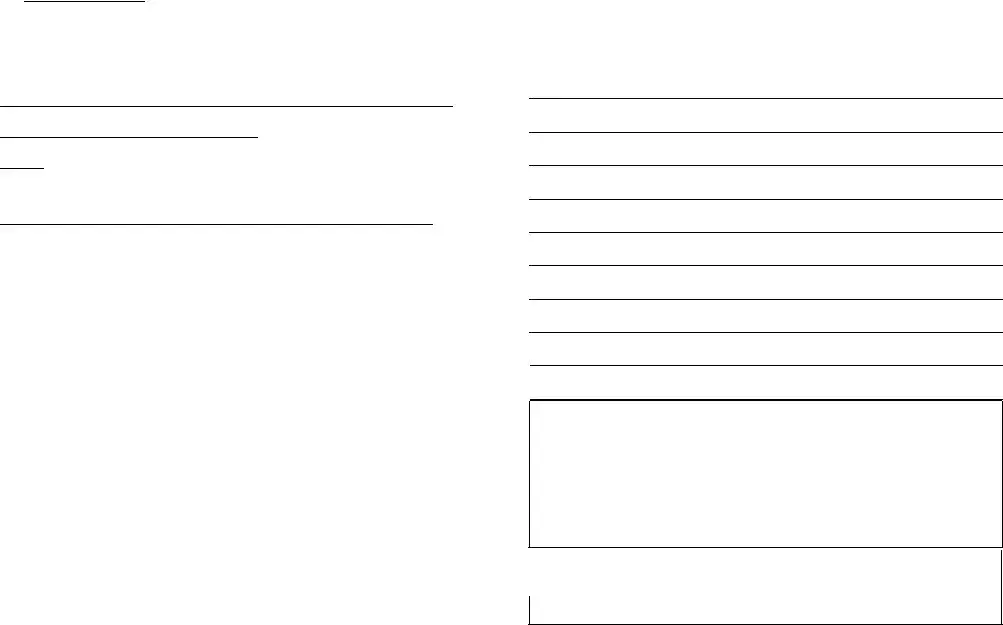

Sometimes, individuals forget to sign the form. A missing signature can halt the entire process, as it serves as your commitment that the information provided is truthful and complete. Always remember to sign and date your form before submission.

b>Misunderstanding the categories of information can also lead to errors. Each section of the form is designed for specific types of information, and mixing them up can create confusion. Take your time to read the instructions thoroughly and ensure you understand what is being asked.

Improperly calculating benefits or eligibility can be another significant mistake. Many may think they can estimate these figures or base them on assumptions. It's vital to use accurate figures and references when determining your eligibility. Consulting with resources or professionals for clarity can save time and headaches later on.

Neglecting to keep a copy of the submitted form for your records can create problems in the future. If any issues arise, having that documentation will make it easier to address errors or follow up on your request. Always retain a copy for your personal records.

Lastly, failing to follow up after submitting the form can result in missed communication or delays. Once you've sent in your form, it’s wise to check on its status after a reasonable time. Doing so ensures you're aware of any additional steps or information needed to continue the process smoothly.

By being aware of these common mistakes and taking the time to avoid them, you can improve your chances of a successful outcome with the U.S. DoL form. A thorough approach can make all the difference in navigating this important process.