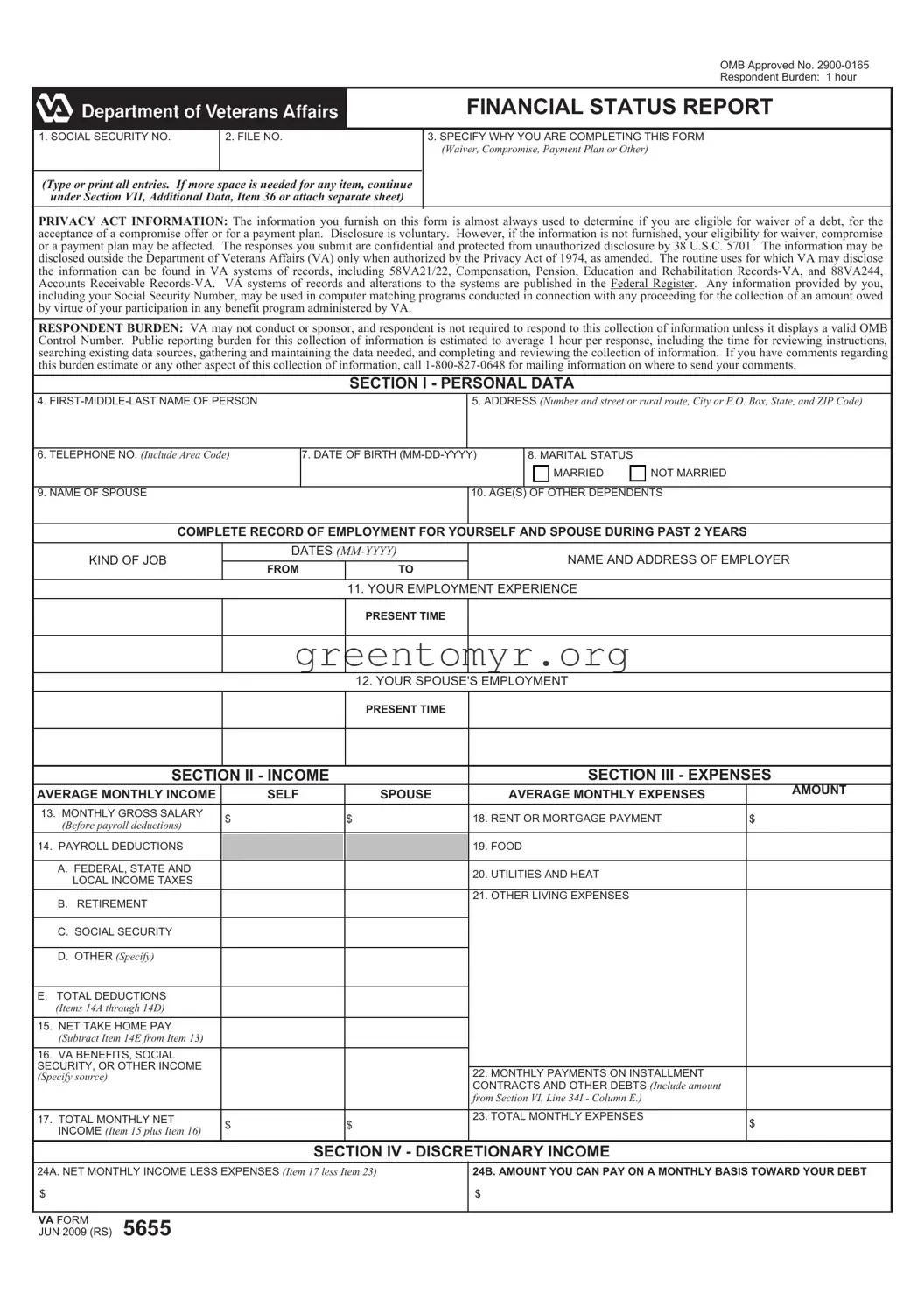

Filling out the VA 5655 form, known as the Financial Status Report, is a crucial step for veterans seeking benefits. However, many people make errors during this process that can lead to delays or reductions in benefits. Recognizing these mistakes can help ensure a smoother submission.

One common mistake is incomplete information. Applicants often leave out critical fields, such as income sources or monthly expenses. Omitting any financial details can raise red flags and result in a request for more information, delaying the processing time.

Another frequent error is providing inaccurate income figures. Some individuals miscalculate their monthly income, either by forgetting to account for all sources or by misreporting figures based on outdated information. This discrepancy can have a significant impact on eligibility and benefit amounts.

Some applicants neglect to include necessary documentation. Supporting documents such as pay stubs, bank statements, or additional income sources must accompany the form. Without these attachments, the application may be considered incomplete.

Inaccurate numbers can also surface when individuals fail to update their financial status. People’s financial conditions can change, and reporting outdated information can lead to incorrect eligibility determinations. Regularly checking and updating financial details is essential.

Individuals might also mistake spousal income as irrelevant, not realizing that it can affect their financial assessment. In communities where married couples combine finances, failing to report a spouse's income can distort the overall picture, leading to errors.

Another mistake is not tracking monthly expenses accurately. Applicants sometimes estimate costs or forget recurring expenses, such as insurance or credit card payments. Underestimating expenses can artificially inflate perceived financial health, resulting in a potential denial of benefits.

Some veterans neglect to sign the form. A missing signature can prevent the form from being officially recognized, causing delays in processing or requiring a complete resubmission.

Lastly, failing to review the completed form can lead to overlooked errors. Taking the time to double-check the form before submission can help catch mistakes, ensuring that all information is accurate and complete.

Ensuring correctness during the completion of the VA 5655 form is vital. By avoiding these common pitfalls, veterans can enhance their chances of receiving timely and adequate benefits.

$

$