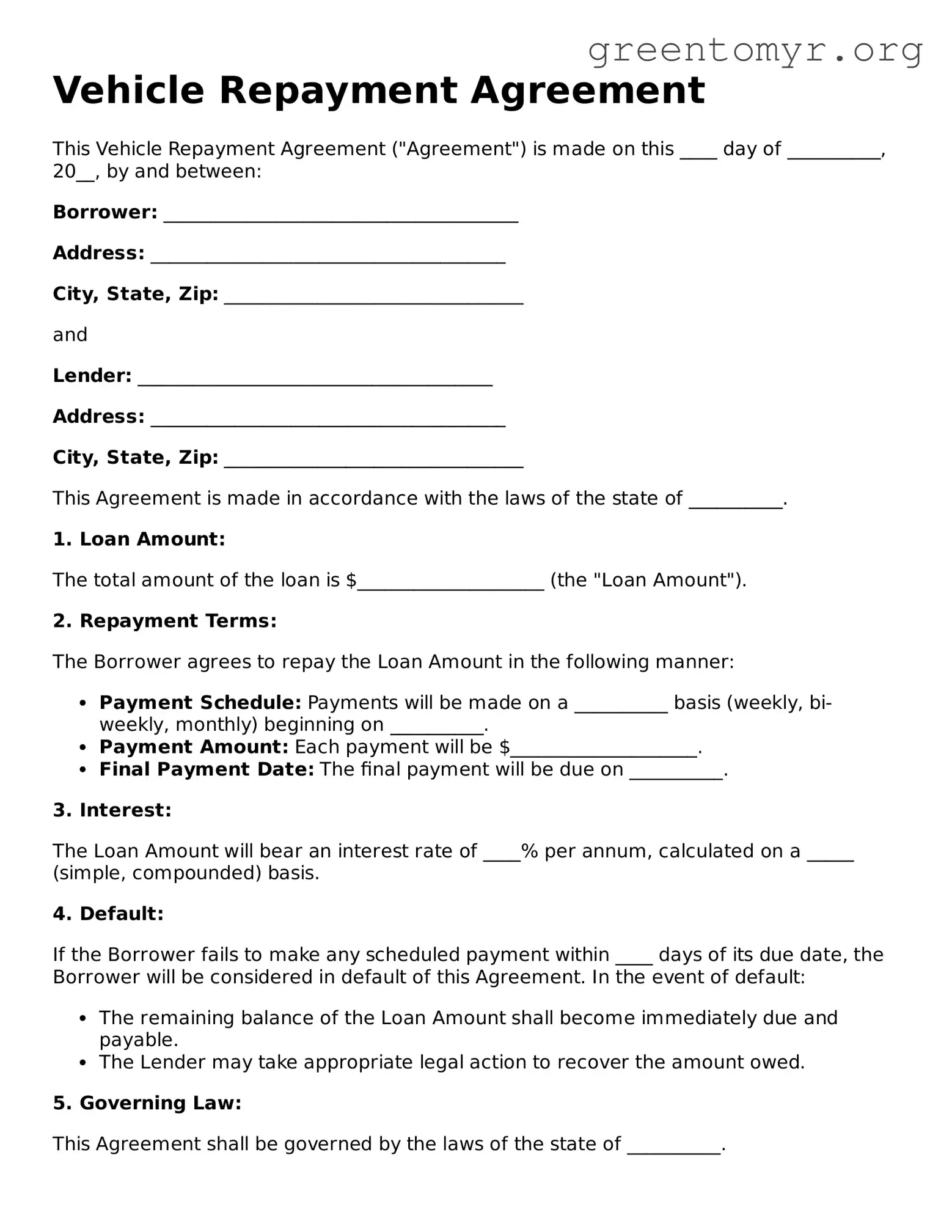

Vehicle Repayment Agreement

This Vehicle Repayment Agreement ("Agreement") is made on this ____ day of __________, 20__, by and between:

Borrower: ______________________________________

Address: ______________________________________

City, State, Zip: ________________________________

and

Lender: ______________________________________

Address: ______________________________________

City, State, Zip: ________________________________

This Agreement is made in accordance with the laws of the state of __________.

1. Loan Amount:

The total amount of the loan is $____________________ (the "Loan Amount").

2. Repayment Terms:

The Borrower agrees to repay the Loan Amount in the following manner:

- Payment Schedule: Payments will be made on a __________ basis (weekly, bi-weekly, monthly) beginning on __________.

- Payment Amount: Each payment will be $____________________.

- Final Payment Date: The final payment will be due on __________.

3. Interest:

The Loan Amount will bear an interest rate of ____% per annum, calculated on a _____ (simple, compounded) basis.

4. Default:

If the Borrower fails to make any scheduled payment within ____ days of its due date, the Borrower will be considered in default of this Agreement. In the event of default:

- The remaining balance of the Loan Amount shall become immediately due and payable.

- The Lender may take appropriate legal action to recover the amount owed.

5. Governing Law:

This Agreement shall be governed by the laws of the state of __________.

6. Entire Agreement:

This Agreement constitutes the entire understanding between the parties and supersedes all prior agreements, discussions, or representations.

7. Signatures:

By signing below, both parties agree to the terms set forth in this Vehicle Repayment Agreement.

Borrower’s Signature: ___________________________

Date: _______________________________________

Lender’s Signature: ___________________________

Date: _______________________________________